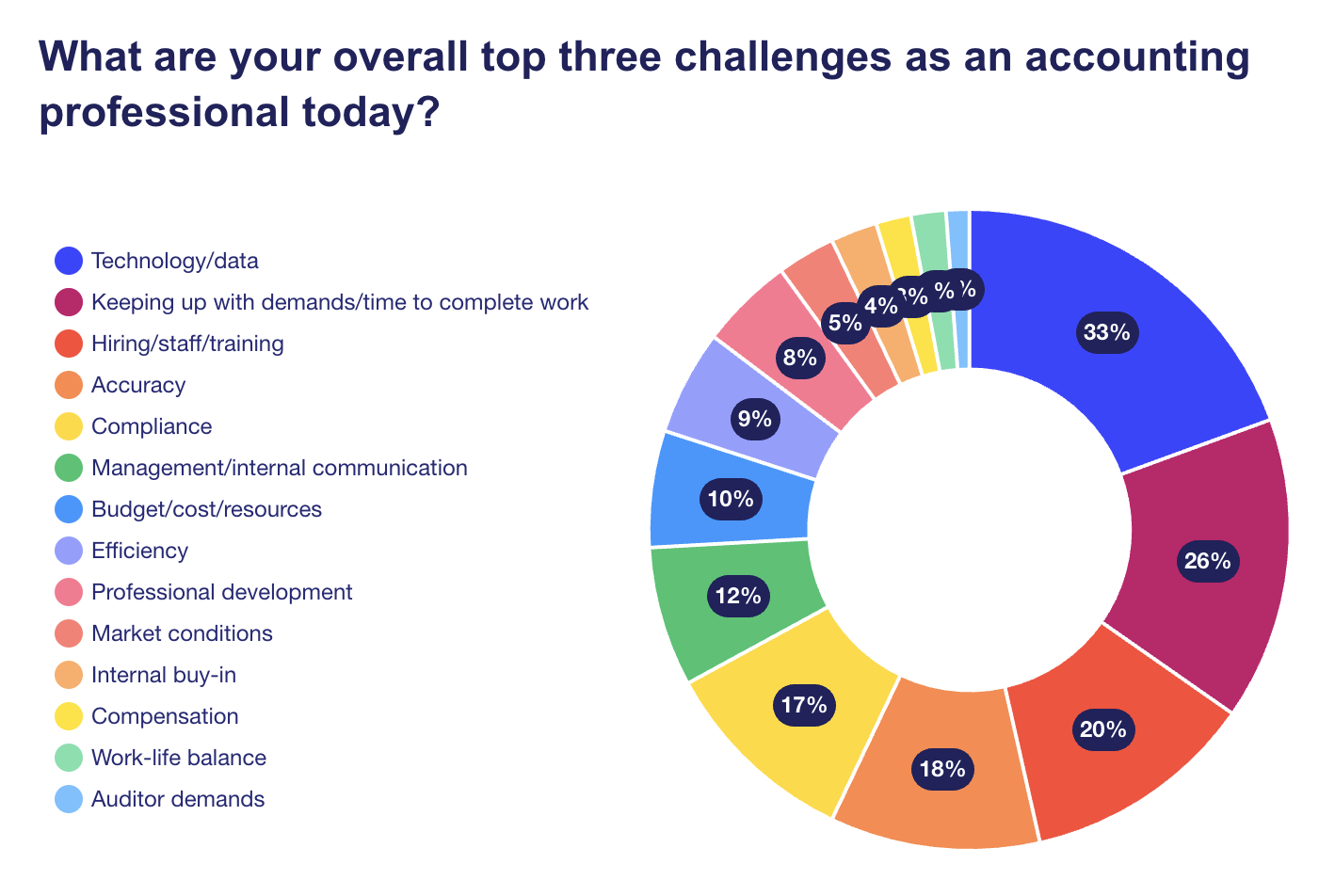

Leapfin recently polled nearly 300 accounting and finance professionals for a State of Automation for Revenue Accounting survey. When asked to share their biggest challenges as an accounting professional, respondents said Technology and Data is number one.

For an industry driven by precision, compliance, and efficiency, that statistic is a wake-up call. Technology and data should make life easier, so why do finance pros feel they’re the biggest part of the problem?

Here are four leading reasons why accountants struggle with technology and data.

1. Accountants rely on a fragmented tech stack that doesn’t play nice

Modern accounting is built on technology and data. Accounting teams still need to possess the hard skills and knowledge of accounting regulations, policies, and practices, but the power and sophistication of the finance tech stack is now arguably as important as that – if not more so.

At a very foundational level, for Accountants to do their jobs, they must rely on several systems and providers, including.

- Payment service providers (PSPs) like Stripe, Shopify, PayPal, Apple Pay, Google Pay, and more that collect transaction data.

- Order Management systems like Zuora that manage subscription data.

- ERPs such as NetSuite that organize operational revenue data.

- Internal billing systems and data warehouses that store key customer and business records.

These revenue and transaction systems don’t all talk to each other. In fact, they don’t even all speak the same language.

- Finance systems organize information differently. They house data and reports in different places and under different labels.

- The structure and completeness of data in different systems can vary greatly. For some specific Stripe examples, read 3 Ways Stripe’s Out-of-the-Box Reporting Falls Short for Accountants

- The integrations between these systems are not all equal, which can result in missing, incompatible, or extraneous data being passed between them. Getting necessary data from Stripe to NetSuite is a common and particularly painful challenge. For details, examples, and solutions, watch our on-demand webinar, 5 Reasons You’ll Regret Connecting Stripe to NetSuite to Solve Your Revenue Reporting Problem

2. Accountants lack easy access to critical revenue data

Finance and revenue systems offer varying levels of access for Accounting teams. This is problematic for a few reasons:

- Accountants often must depend on engineers to extract data and reports they need, even from company “owned” internal data warehouses.

- And because accounting is usually towards the bottom of engineering’s priority list, it can take upwards of a week or longer to get necessary data and reports.

- Delays in reporting can stall strategic decision-making and erode confidence in accounting.

- All of this means accountants are constantly playing catch-up and shouldering additional stress.

Leapfin eliminates these problems by providing Finance and Accounting teams (and the business overall) with a single source of truth for all revenue data, automatically consolidated and universally standardized.

Leapfin users have the added advantage of being able to use Luca, the first AI data reporting agent for accountants. Accountants can chat with Luca to create and refine any kind of financial report. No SQL or data engineers needed! Lean more about Luca here

3. Accountants are burdened and burned out by manual data management

Accountants aren’t excited to admit it, but much of their jobs is spreadsheet and data management. Here’s why:

- It’s frustrating enough that critical revenue systems don’t speak the same language. But absolutely none of them are built for accountants. All the transaction data from these different systems is useless to an accountant unless it’s organized, normalized (aka standardized), correctly labeled according to the company’s internal policies, and complete, meaning it’s not missing critical information necessary for accurate reporting and meeting industry compliance requirements.

- The vast majority of an accountant’s time is spent manually consolidating and normalizing the data, just so they can meet month-end deadlines. That doesn’t leave much time for strategic, value-add projects for company leadership and cross-functional departments like product, marketing, sales, customer support, etc.

- 30% of professionals say they are unhappy or very unhappy with the level of manual effort required to complete revenue recognition each month

- Survey respondents listed too many manual processes as the second most challenging aspect of rev rec behind finding and fixing errors.

- And finding and fixing errors is number one in large part because of the manual effort needed to do so effectively.

- Manual workflows increase the risk of errors in financial reports, which can lead to compliance issues and audit penalties.

The data preparation necessary to perform month-end close, including revenue recognition and reconciliation, is a relentless cycle of manual work that doesn’t change. By the time one month’s close is done, the next begins. With no time to focus on higher-value, strategic tasks, all of this repetition breeds burnout.

Learn why poor data is the top challenge for accountants today.

4. Accountants are overwhelmed with scaling transaction volumes

More growth = more transactions, complexity, or both = more headaches.

Without automation, teams simply can’t keep up. This bottleneck not only delays reporting but increases the risk of errors.

In addition to the finance systems teams often rely on, another tool that’s holding accountants back is Excel. Excel is powerful, but it’s not built for large-scale, collaborative accounting.

- The way to do more faster in Excel is with the help of formulas and macros. But fragile Excel formulas break with complex datasets, and accountants have to go looking for the needle in the hay stack to find the error and fix it.

- Crashes happen when files grow too big. Excel caps out at around one million rows (give or take). Accountants at high-volume businesses can attest, it’s easier than you think to max that Excel limit out. So what do most people do? They break the data apart into multiple Excel workbooks. Now all those formulas need to be applied multiple times in multiple places, and finding and fixing errors becomes even more of a chore.

- Collaboration in Excel isn’t really a thing. Between version control issues and other workflow inefficiencies, teamwork slows to a crawl.

It’s time to rethink accounting’s biggest challenges

Technology and data are necessary, but they are not evils. Automation is helping teams streamline processes, improve accuracy, and keep up with the pace of business growth.

If you’re caught in the status quo feeling like you don’t have the resources or support to modernize your team and tech stack, watch this recorded webinar to hear how the CFO at Help Scout, Shawna Fisher, budgets differently for better accounting outcomes.

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.