This is the third chapter of a series of blog posts regarding cash reconciliation for accountants. Below are all topics included in this series:

- An Accountant’s Guide to Order to Cash

- Introduction to Cash Reconciliation

- 4 Reasons Why Accounting Teams Need Cash Reconciliations

- How to Perform a Cash Reconciliation: A Step-By-Step Guide for Accountants

- How to Perform a Cash Reconciliation: A Real-World Example

- 5 Most Common Problems When Performing a Cash Reconciliation

The second post defines cash reconciliations and explains how they’re performed at a high level. This post will discuss why cash reconciliations are important for accounting teams, particularly at high growth Internet companies.

Find out why cash reconciliations are essential — and how to automate them.What Value Do Cash Reconciliations Provide Businesses?

First and foremost, cash reconciliations ensure that cash and revenue balances are reported accurately. By its nature, this assurance has several additional implications, listed below.

- Verification that operations are functioning properly and the company is collecting on all sales.

- Prevention of revenue leakage.

- Provision of trustworthy cash balances and revenue calculations for investors and stakeholders.

- Testing and assurance of data integrity across a company’s financial system, especially the revenue recognition system.

Problems That Arise Without Cash Reconcilations

Without cash reconciliations, businesses will find their financial reports inconsistent and unreliable.

For instance, cash can be inconsistently reported across financial systems (e.g.: billing system vs. revenue recognition system). In this case, misstated cash in the revenue recognition system can lead to misstated revenue.

In another scenario, Accounting, FP&A, Tax, and Business teams may all report different cash numbers. When there is no single financial source of truth for the company, inconsistent cash reporting is a common issue. Some major consequences of such include management making decisions based on erroneous data and over/underpayment of the company’s tax obligation.

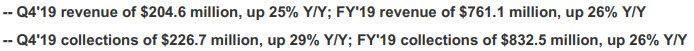

Lastly, cash reconciliations prevent inconsistent metrics and KPIs on financial statements. For example, in Wix’s Q4 2019 Press Release the company reported both year-over-year revenue metrics and year-over-year collections metrics as such:

Typically, revenue metrics are provided by Accounting, while collections (AKA billings or bookings) are reported by FP&A. If reporting across these two teams are based on different cash balances, the result would be incorrect and potentially misleading for external parties.

Cash Reconcilations Can Be Difficult

With disparate data sources, complex business models, and high transaction volume, cash reconciliations quickly become challenging. In the previous post, we explained how a cash reconciliation is completed at a high level.

In our next two posts, we’ll explore more complex examples in detail.

Read next: How to Perform a Cash Reconciliation: A Step-By-Step Guide for Accountants

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.