It’s no secret that the Software as a Service, or SaaS, software delivery model has become the norm across companies, from B2B, B2C, and every type in between. There is a sense of comfort to investors when future revenue can be confidently predicted; but getting to that comfort level is where Finance professionals run into some hurdles.

Prior to SaaS, it’s safe to say that almost all tech and software companies ran a perpetual license model (think: one-time transaction). Accounting was pretty straightforward: sell product > receive payment > transfer product > recognize revenue immediately. Now, imagine applying that methodology to SaaS. Is the good transferred when the contract is won? When the customer uses the solution? This is where we breakdown four ways we’ve seen SaaS change how accounting is done.

1) Recognizing Revenue Over a Period of Time

According to FASB, revenue recognition is defined as such: “an entity should recognize revenue when (or as) it satisfies a performance obligation by transferring a promised good or service to a customer. A good or service is transferred when (or as) the customer obtains control of that good or service.” This works with the aforementioned “perpetual” model. With the introduction of subscriptions, companies now have to recognize revenue over the length of the agreed-upon contract. So, to dig into FASB’s definition of satisfying a good or service, this rewrites to: “an entity shall recognize revenue over time by consistently applying a method of measuring the progress toward complete satisfaction of that performance obligation.”

Summary:

Old model: customer buys the ownership rights to the software and hosts within the organization. Because good or service is transferred immediately, all revenue is recognized upfront.

New model: customer is buying a time period to access a hosted service based on a proprietary software and does not get to own a copy of the software. Because the good or service is delivered over the contract period, the revenue must be distributed over said period.

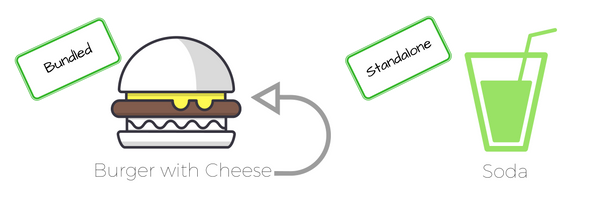

2) Professional Services and Standalone Value

It’s very rare (in the B2B world) that a SaaS solution isn’t paired with some sort of additional fee, like implementation or ongoing services. In accounting, these fees are considered to be multiple elements, and determining how this revenue should be recognized depends greatly on if the services have standalone value to the customer outside of the hosted subscription.

Companies need to define how they break out these fees and services. If the professional services prove standalone value, they can be separated from the subscription contract and recognize revenue once the services are performed. (Easy.) However, if the professional services do not have standalone value (i.e. required services for customer to use subscription), then they would be treated as set-up fees and recognized over the initial contract period (or over the expected life of the customer).

Summary:

Establish an internal understanding of the professional services your team is selling and the value it provides to your customer (as it relates to your SaaS product). This internal clarity will help inform your recognition strategy for set-up fees.

3) Data Living in Multiple Sources

With the rise of the SaaS model, came a rise for technology. An ERP won’t suffice anymore due to its transactional legacy nature, and yet, most ERP’s can’t fully be ripped out as organizations outside of Finance rely on it. So, supplementary technologies have been developed to handle subscriptions and more complex accounting, including payment gateways (Stripe, PayPal), subscription management solutions (Recurly, Zuora), and CPQ solutions (Apptus, Steelbrick).

While having a robust tech stack is helpful for what each is intended for, consolidating the data living within them can be cumbersome. Accounting is stalled trying to get the information into one spot (usually Excel) to start reporting on and closing the books.

Summary: New business models are forcing companies to grow and evolve their tech stack. This evolution leads to data fragmentation, which causes major headaches for finance professionals.

4) Increase of Non-GAAP Metrics

While GAAP metrics are essential to financial reporting, the rise of SaaS has yielded non-GAAP metrics that truly reflect the health of a subscription business. SaaS leaders see the importance of defining and tracking metrics like MRR, churn, contraction, and expansion, since they feel it better reflects the strength of their business today and into the future.

Summary: GAAP reporting remains extremely important from a reporting and compliance perspective. However, SaaS finance teams need to also track non-GAAP metrics to fully measure the health of the business.