This is the second blog in a series on ASC 606 outlining how to implement and leverage these standards in your accounting. In the previous blog post, we talked about the five-step ASC 606 revenue recognition process. This blog discusses revenue recognition examples and how to treat them under ASC 606. The third blog in our series covers ASC 606 implications for warranties. In the final one, we cover practical expedients under ASC 606.

ASC 606 revenue recognition examples and what you can learn from them

This article explains the accounting treatment of implementing the revenue recognition steps, including allocating transaction prices and recording journal entries.

Watch how Leapfin automates ASC 606 revenue recognition.

How to Allocate the Transaction Price of Each Performance Obligation

Once you’ve identified the contract with a customer and specified performance obligations, payment terms, and rights of the buyer and seller, the next step is to determine the transaction price of each performance obligation.

Suppose you’re a software company that sells software licenses and ongoing subscriptions. Here’s what your price book and the customer order look like:

- Your price book for a software license is $600, and your subscription plan is $180.

- The selling price of the software license is $500 net with a $100 discount from a $600 gross.

- The 12-month subscription plan price is $180.

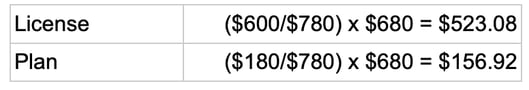

The sum of the 2 performance obligations, less the discount, is $680. However, as you’re allocating the discount, it must be distributed across the software license and the subscription plan equally depending on their percentage related to the total sum. To calculate the price of the license and the plan after the discount, you need first to calculate the percentage of the total for each and then multiply it by $100 to figure out how much to discount each.

The next step is to allocate the transaction price among the performance obligations. Instead of individually pricing the two services to your customer, you offer a package deal for the license, the 12-month plan, and the discount. Let’s go through the order-to-cash process step by step.

ASC 606 examples: recording journal entires

First, when the customer first signs the contract, you need to defer the contract plan revenue, $180, over the course of 12 months and then recognize the immediate license purchase, $600. However, you also need to recognize the contract discount, $100, as noted above. Consequently, you end up with the following journal entries:

| Contract Signed | Account | DR | CR |

| Contract plan over a year | Deferred Revenue | $180.00 | |

| Account Receivable | $180.00 |

| Contract Signed | Account | DR | CR |

| Immediate License | Account Receivable | $600.00 | |

| Revenue | $600.00 |

| Contract Discounts | Account | DR | CR |

| Discount | Provisions for Discounts | $100.00 | |

| Immediate License | Accounts Receivable | $76.92 | |

| Contract Plan over a Year | Accounts Receivable | $23.08 |

After you perform month one of service and the customer receives their license, you need to recognize the immediate revenue you received for the subscription license and the monthly subscription plan payment. At the same time, you need to recognize the discount for the immediate license purchase and the plan discount for each month. Since you sell the software license and deliver it in the first month of service, you recognize $600 in license revenue right away, and you would also need to recognize the license discount, $76.92, in full.

While the total cost of the annual plan is $180, you would receive $15 a month. However, you also need to factor in the discount for the plan, which is $23.08 over 12 months of the subscription or $1.92 a month. You net $13.08 a month in subscription plan revenue.

Per ASC-606 guidelines, you must recognize the plan and license revenue separately from the performed discounts.

| Performed Contract MoM | Account | DR | CR |

| Contract plan over a year | Deferred Revenue | $15.00 | |

| Service Revenue | $15.00 |

| Performed Contract MoM | Account | DR | CR |

| Immediate License | Purchase Revenue | $600.00 | |

| Deferred Revenue | $600.00 |

| Performed Discounts | Account | DR | CR |

| Contract Plan over a Year | Contra Revenue Discounts | $1.92 | |

| Provisions for Discounts | $1.92 |

| Performed Discounts | Account | DR | CR |

| Immediate License | Contra Revenue Discounts | $76.92 | |

| Provisions for Discounts | $76.92 |

Then, once cash is received, you would create entries that reflect this receipt:

| Cash Received | Account | DR | CR |

| Contract Plan over a Year | Cash | $13.08 | |

| Account Receivable | $13.08 |

| Cash Received | Account | DR | CR |

| Immediate License | Cash | $523.08 | |

| Account Receivable | $523.08 |

ASC 606 informs standalone pricing estimation when needed. It also includes guidance for allocating discounts in contract terms to reflect what you’re charging your customers.

Key Takeaway

Under ASC 606, not all contract revenue will be recognized upfront, even if your company has been paid in full. Moreover, if there are discounts applied to your offering, you need to recognize those discounts separately and allocate them evenly across each line item in the customer’s order.

ASC 606 also requires extended disclosures in the financial statements, and your company must provide details about performance obligations and the associated assets and liabilities.

Use these ASC 606 revenue recognition examples to make financial reporting more accurate for your company

Failure to record and understand the ASC 606 impact of these entries could result in a company overstating liabilities and understating revenue. To ensure accurate financial reporting, leadership must take action on these knowledge gaps by either training staff, outsourcing, or investing in high-performing employees.

Moreover, by creating journal entries for each revenue recognition activity, discounts included, you can then empower your team with more insight and information into how money flows in and out of the business. Your team can then use this information to influence their discounting strategy, payment terms, and more.

While adhering to accounting compliance with regulatory reporting standards can be tough, maintaining tight month-end control doesn’t have to be. The good news is that Leapfin can help your accounting team shorten month-end close, adhere to regulatory requirements, and conduct quick and easy audits. And your entire Finance team can benefit from Leapfin, too.

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.