This is the first of blogs in a series on ASC 606 outlining how to implement and leverage these standards in your accounting. In this blog, we talk about implementing ASC 606 for private companies and the Revenue Recognition practices it involves. The next blog discusses revenue recognition examples and how to treat them under ASC 606. The third blog in our series covers ASC 606 implications for warranties. In the final one, we cover practical expedients under ASC 606.

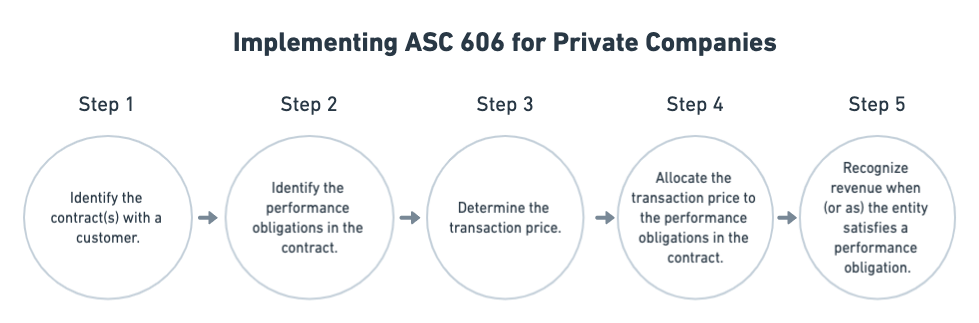

Accounting Standards Codification (ASC) Topic 606, issued in 2019, outlines a five-step process companies must use to recognize revenue. The Financial Accounting and Standards Board (FASB) issued this guidance to provide more transparency through extended disclosure requirements about revenue recognition.

What are the ASC 606 revenue recognition requirements?

Revenue recognition is the process of accounting for the payment a company expects to receive for goods and services provided to customers. Simply put, it’s how businesses record sales transactions from customers.

Previous accounting standards required companies to recognize revenue as accrued, regardless of when cash is received. Revenue recognition under ASC 606 requires companies to pay closer attention to customer contracts: evaluating the nature of services provided, service duration, and the amount. Here’s how ASC 606 defines these parameters:

- Specifying the type of services provided is essential to identifying the contract’s performance obligations.

- The timing of services indicates the number of periods — months or years — in which a company will recognize revenue.

- The amount of money recorded in the financial statements represents the price of all performance obligations specified in the customer contract.

Implementing ASC 606 for Private Companies

Small businesses usually have simple revenue cycles, so tracking contract terms, prices, and performance obligations is easier. But as they grow, most businesses discover they need the internal expertise to implement complex standards like ASC 606.

Other issues with implementing ASC 606 include creating repeatable processes for contract reviews while improving systems to accommodate revenue recognition standards, different transactions from different sources, and activities spread across multiple accounting periods. Here’s a detailed look at what companies must consider as they operate under ASC 606.

1. Identify the contract(s) with a customer.

Contracts exist in written or oral form with enforceable rights and obligations. Companies must consider the following criteria when identifying contracts with customers: commitment and rights of the parties, payment terms, collectability, and the commercial substance of the transaction.

For example, If a company charges customers subscriptions and onboarding fees, the contracts must specify the agreement to provide subscriptions and the period over which this subscription will be delivered to a customer, monthly or annually, for example. The contract must also specify the customer’s agreement to pay and the amount and timing of payment. While some fee revenue will be recognized immediately, revenue that hasn’t yet been earned will be recorded as deferred revenue and recorded in the period that the company’s performance obligations are met.

2. Identify the performance obligations in the contract.

Some obligations can be separated from others. For example, if a subscription company agrees to provide an annual software subscription with a one-time onboarding fee, and a custom integration fee, these charges count as three distinct performance obligations that may be tracked in different operational tools.

This step of contract evaluation often involves cross-functional communication between accounting, legal, and sales to agree on what’s being provided to customers, for how much, and when. To ease cross-functional communication, finance teams can unify these transaction activities in one finance data platform to help them recognize revenue in the right period and track the transaction journey in one place.

3. Determine the transaction price.

Next, companies must determine the transaction price, the payment, or consideration given to the company in exchange for providing products and services. Determining price is harder than it seems because it requires granular information about historical transactions, discounts, disputes, and fees across your entire customer base.

This information is usually spread across multiple operational tools that don’t easily integrate. To set the right price, finance teams need systems that help them centralize individual transaction data in one place so they can easily segment it to run detailed analyses.

4. Allocate the transaction price to the performance obligations in the contract.

When there is more than one performance obligation, the firm must allocate the transaction price to each obligation. The Financial Accounting Standards Boards (FASB) provides guidance for estimating standalone pricing. It also includes guidance for allocating discounts or accounting for changes in contract terms.

5. Recognize revenue when (or as) the entity satisfies a performance obligation.

Revenue is recognized when the company satisfies the performance obligation, which may occur over multiple periods. For example, a company with a one-year customer contract recognizes revenue over the 12 periods as it satisfies performance obligations.

ASC 696 gives finance leaders a view of their business, which includes sales, pricing, and customer behavior. With this view, finance leads can learn more about typical customers’ needs, performance obligations, pricing, and when they can recognize revenue. Finance leaders can also identify operational efficiency improvement areas such as optimizing warranty pricing, where the company is spending too much money to sell goods, and where they are losing money due to disputes.

To identify areas of improvement, it’s best to understand your transactions. For this, you may consider investing or exploring finance data platforms that can help you view your transactions, automate ledger entry creation, and help you adhere to ASC 606 standards.

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.