This is the fourth chapter of a series of blog posts regarding cash reconciliation for accountants. Below are all topics included in this series:

- An Accountant’s Guide to Order to Cash

- Introduction to Cash Reconciliation

- 4 Reasons Why Accounting Teams Need Cash Reconciliations

- How to Perform a Cash Reconciliation: A Step-By-Step Guide for Accountants

- How to Perform a Cash Reconciliation: A Real-World Example

- 5 Most Common Problems When Performing a Cash Reconciliation

In the previous chapters, you learned on a high level what cash reconciliations are and why they’re critical for accounting teams. In the next two chapters, you will learn how to perform each step of a cash reconciliation and apply your learnings to an example company.

Get the 11 key questions to ask before automating your reconciliations.

The Goal of a Cash Reconciliation Is to Account for All Differences Between 4 Systems

A comprehensive cash reconciliation should include a 4-way match across the following financial systems. We described these systems in detail in Chapter 2: Introduction to Cash Reconciliation.

– Billing System

– Revenue Recognition System

– Payment Processor

– Bank

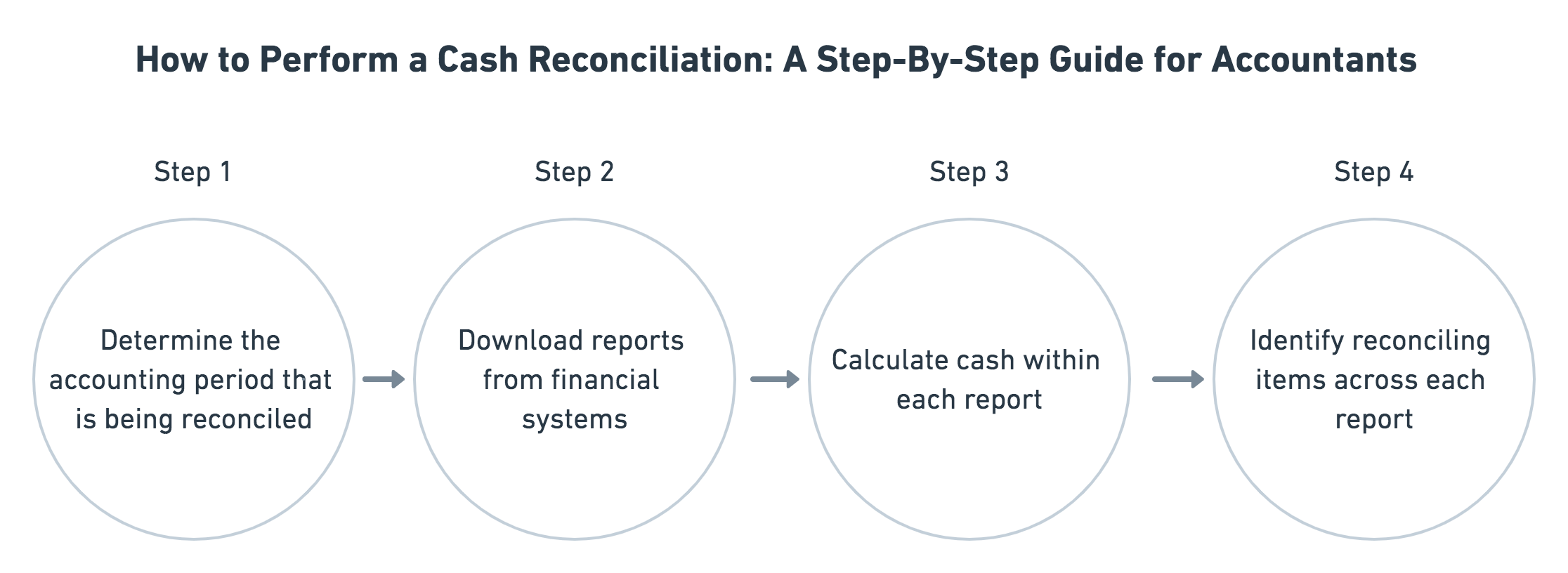

How to Perform a Cash Reconciliation

Step 1: Determine the accounting period that is being reconciled

Examples include 5/1/2020 – 5/31/2020, 1/1/2019 – 12/31/2019, or even 4/15/2020 – 5/15/2020.

Step 2: Download reports from financial systems

– Billing System (Cash Report): All sales transactions that occurred within the accounting period.

– Revenue Recognition System (Cash Report): All sales transactions processed through the system within the accounting period. Download all sales transactions (e.g. cash), not all revenue that was recognized in the accounting period. This is because revenue will include sales from prior period as well.

– Payment Processor (Payout Report): All payouts from the payment processor within the accounting period. Payouts are cash transfers made from the company’s payment processor to the company’s bank account. Payment processors typically generate payouts in batched quantities. This means that sales transactions from multiple days can be batched into a single payout (e.g. sales from 2/15 and 2/16 are batched into one payout on 2/16). We will need 2 versions of the Payout Report:

Payouts net of fees withheld by payment processor

Payouts gross of fees withheld by payment processor

– Bank (Bank Statement): Bank statements may include incoming and outgoing cash related to other business activity. The bank statement will need to be filtered to only include transactions from sales.

Step 3: Calculate cash within each report

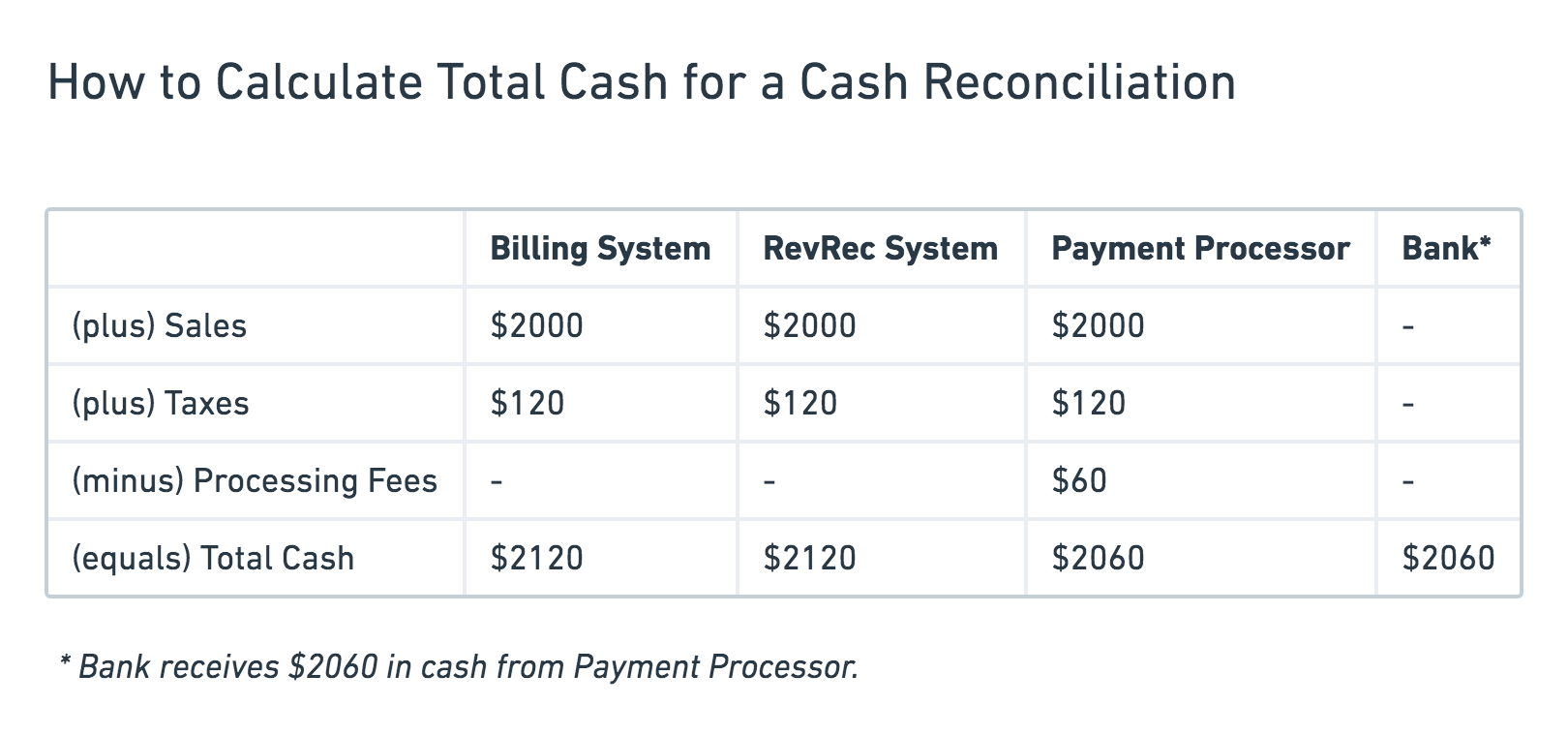

In the following example, we demonstrate how to calculate the total cash within each system.

Example: In March, Company made $2,000 in sales and charged 6% taxes. Payment processor charged a 3% processing fee.

For most subscription businesses, revenue is recognized gross of any fees incurred related to the sale (e.g. payment processor fees) and net of any taxes collected.

Step 4: Identify reconciling items across the report

– Compare cash between Billing System and RevRec System

These should match when reviewing the same accounting period.

– Compare cash between Billing System/RevRec System and Payment Processor payouts

We will generally see differences here. As mentioned earlier, payouts are batched and can include sales transactions from more than 1 day (e.g. sales from 2/15 and 2/16). In order to reconcile, we need to identify the payouts that include transactions outside of the accounting period in question (e.g. a payout on 3/1 that includes transactions from 2/28). Once those payouts are identified, we need to exclude the specific transactions outside the accounting period from the total payout amount. These excluded transactions are the reconciling items for identified differences.

– Compare Payment Processor payouts and Bank cash

We will generally see differences here as well. This is due to payments from the payment processor that are in-transit. These in-transit payments will be the reconciling items for identified differences.

Example: The payment processor creates and sends a payout of $100 to the bank on 3/31 at 11:50pm EST. The bank receives and records the cash receipt on 4/1 at 7:00am EST. For the accounting period 3/1 – 3/31, the payment processor cash will include the payout of $100, while the bank statement will exclude the receipt of $100.

Notes on Payment Processor Cash

Payment Processors will typically keep a percentage of each transaction as a fee. This fee is an expense and is reported as COGS on the P&L. Payment Processors will have reporting that allows companies to review transactions and payouts gross versus net of fees.

When comparing Payment Processor cash to the Billing System/RevRec System cash, payout cash must be assessed gross of fees.

When comparing Payment Processor cash to the Bank statement, payout cash must be assessed net of fees, as fees will be withheld by the Payment Processor and not get transferred to the bank account.

Below is an example journal entry to capture fees. Since the Payment Processor will withhold the cash, Accounts Receivable must be decreased.

| Month | Account | DR | CR |

|---|---|---|---|

| Jan 3 | Payment Processing Fees (Expense) | $500 | |

| Accounts Receivable | $500 |

In the next chapter, we will go through each of these steps for an example subscription company. It will include sample report screenshots, detailed calculations, and much more.

Read next: How to Perform a Cash Reconciliation: A Real-World Example

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.