This is the second chapter of a series of blog posts regarding cash reconciliation for accountants. Below are all topics included in this series:

- An Accountant’s Guide to Order to Cash

- Introduction to Cash Reconciliation

- 4 Reasons Why Accounting Teams Need Cash Reconciliations

- How to Perform a Cash Reconciliation – A Step-By-Step Guide for Accountants

- How to Perform a Cash Reconciliation: A Real-World Example

- 5 Most Common Problems When Performing a Cash Reconciliation

As discussed in the first post in this series, Order to Cash describes the procedure for processing customer orders, applying payments to invoices, and matching payments to the cash received in a company’s bank account.

In this process, cash flows through a number of systems described in detail below.

Accountants perform cash reconciliations to ensure that cash has appropriately gone through these systems for each transaction.

Get the 11 key questions that can guide your cash reconciliation automation.What Is a Cash Reconciliation?

A cash reconciliation is the process of verifying the completeness of a sale or transaction across the company’s financial systems. Its completion provides assurance for both cash and revenue balances.

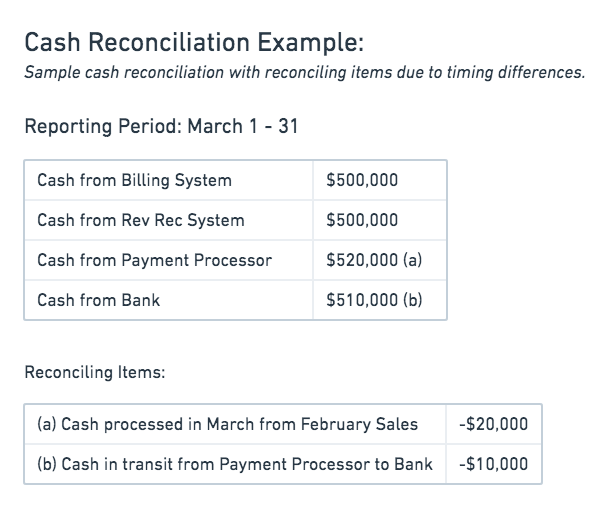

Multiple financial systems are involved in a cash reconciliation and generally, cash balances across these systems do not match.

We’ll explore cash reconciliations further below, but first we’d like to address a common misconception.

Cash Reconciliation vs. Bank Reconciliation

Cash reconciliations are often misunderstood to be the same thing as bank reconciliations.

A bank reconciliation is the process of matching transaction amounts reported in a bank statement with those recorded in the general ledger. Its purpose is to ensure that the cash balance recorded in the general ledger aligns with the entity’s actual cash balance in the company’s bank account. While companies and banks record the same transactions, the time at which a company records cash in the general ledger often differs from the time at which their bank reports the associated change.

Systems Involved in a Cash Reconciliation

A cash reconciliation is more complex and comprehensive than a bank reconciliation because it involves a company’s entire financial technology stack. Below are the four most common systems involved in a cash reconciliation. They can vary depending on company size, business model, or technological maturity.

Billing System:

A billing system creates and manages customer invoices that allow customers to pay for their purchases. Cash from billing systems represent how much cash is expected to be collected from sales.

- Examples: Aria, Chargebee, Recurly

Payment Processor:

A payment processor relays customers’ payment information to a company’s bank and the customers’ banks in order to complete a transaction. It verifies payment legitimacy and provides instructions to banks for fund transfers. Cash from payment processors represent the final cash received by the company’s bank.

- Examples: Stripe, Adyen, Braintree/PayPal, WorldPay

Company’s Bank:

A company’s bank collects and deposits the cash from transactions that are successfully processed by payment processors. It is the final system involved in a cash reconciliation.

- Examples: Bank of America, JP Morgan Chase, Wells Fargo

Revenue Recognition System:

A revenue recognition system calculates revenue for the current period and liabilities for future deferred revenues. It ingests information from both billing systems and payment processors to perform these calculations according to the company’s arrangements and policies.

- Examples: Leapfin, NetSuite ARM, Zuora RevPro

Generally, the cash balances across these systems do not match, which is precisely why accounting teams need to perform cash reconciliations.

Common reasons for mismatch across these financial systems include:

- Currency differences (Transaction currency, local exchange currency, payout currency)

- Foreign exchange translations (How an international company translates foreign subsidiary earnings into its reporting currency)

- Timing differences (Deposits in transit, time zones, etc.)

How Cash Reconciliations Relate to Deferred Revenue

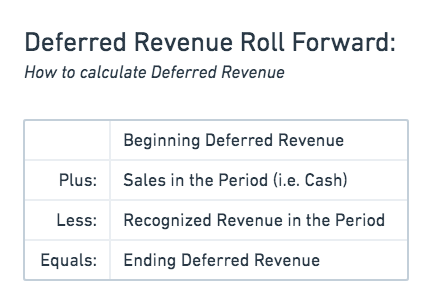

The simplest way to examine the relationship between cash, revenue, and deferred revenue is to understand the deferred revenue roll forward. A deferred revenue roll forward is a simple calculation that ensures incoming and outgoing activities to the deferred revenue balance are properly accounted for.

First, let’s review deferred revenue itself.

Deferred revenue is a cash payment from a customer for goods or services to be provided in the future. Since the seller’s obligation has not been filled, the cash has not been earned, and the seller records this as a liability on the Balance Sheet via a deferred revenue balance. Deferred revenue is especially common among subscription and SaaS companies, in which payments are made upfront in exchange for service periods in the future.

Example: On Jan 1, 2020 a customer makes a $120 purchase for a subscription service spanning Jan 1, 2020 to Dec 31, 2020.

General Ledger Impact:

| Month | Account | DR | CR |

|---|---|---|---|

| Jan 1 | Cash | $120 | |

| Deferred Revenue | $120 |

As the seller completes its obligations over time to earn the revenue, the deferred revenue balance on the Balance Sheet is reduced accordingly by the amount of revenue earned.

Example: The seller recognizes revenue monthly based on the service period of Jan 1, 2020 to Dec 31, 2020. $120 across 12 months results in revenue of $10 per month.

General Ledger Impact:

| Month | Account | DR | CR |

|---|---|---|---|

| Jan 31 | Deferred Revenue | $10 | |

| Revenue | $10 | ||

| Feb 28 | Deferred Revenue | $10 | |

| Revenue | $10 | ||

| March 31 | Deferred Revenue | $10 | |

| Revenue | $10 |

And so forth for April 30, May 31, etc…

At month 12 on Dec 31, 2020, the deferred revenue balance will be fully exhausted as the $120 cash payment would be fully recognized.

Check out our previous blog post on Revenue Cash Accounting for Subscription Businesses for more detailed journal entries.

Cash is Important to Deferred Revenue

Since cash is an important part of the deferred revenue calculation, cash balance figures must be accurate for deferred revenue to be reliable. Accounting teams can be confident in their revenue figures by:

- Performing cash reconciliations to verify that cash activity in the period is accurate

- Comparing the deferred revenue roll forward calculation and deferred revenue balance in the general ledger.

If the beginning deferred revenue, cash, and ending deferred revenue balances have been substantiated, then there is reasonable assurance that revenue for the period is also correct.

It may seem simple in this example, but calculating deferred revenue can be quite complicated. Because revenue is derived from sales in both the current and prior periods, companies with high volume of transactions and/or multiple product lines may experience additional difficulty calculating deferred revenue.

Read next: 4 Reasons Why Accounting Teams Need Cash Reconciliations

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.