With current market conditions, a looming recession, high inflation, and interest rates, debt financing is increasingly complicated. On the one hand, customer budgets are tight, so their willingness to spend with your product decreases, impacting your revenues and, therefore, your budgets. On the other hand, you feel increased pressure to do more with less to help the company thrive and grow, even through uncertainty. Finance reporting is becoming more challenging; audits are more rigorous, requiring monthly or bi-monthly reporting for debt covenants, especially if lenders see lower cash-to-debt ratios.

Accounting is caught in the thick of it because the outputs of your financials determine everything from headcount to product investment to how much capital or debt you can raise within the existing constraints. With these constraints, keeping the current landscape and debt raise challenges in mind is important to determine the best path forward.

Pending economic downturns threaten capital investment and lending

Initial public offerings (IPOs) have remained less frequent over the past few years and have stayed on ice. While special purpose acquisition companies (SPACs) have gained popularity in the past few years, the bloom is off the rose. Earlier-stage companies that aren’t ready for the public markets have also suffered: high-interest rates and inflation have locked up venture capital (VC) markets.

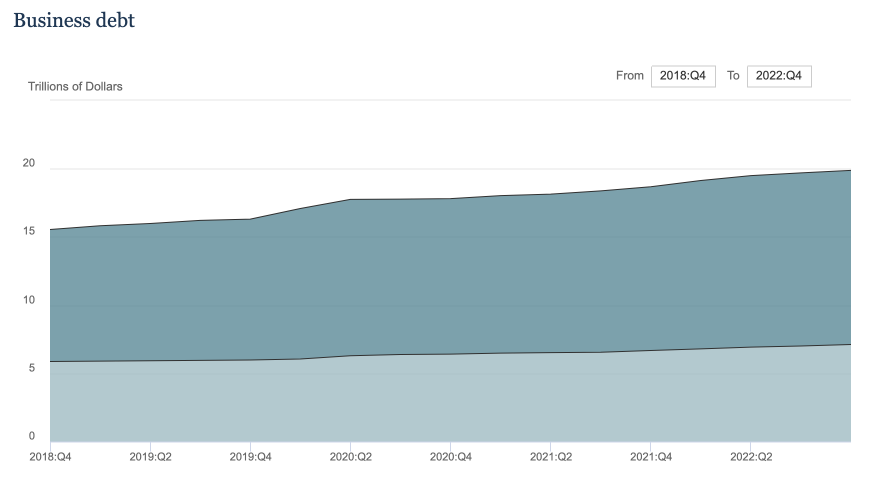

As a result, businesses are increasingly turning to debt as a critical financing mechanism. Business debt has steadily increased, reaching around 12 trillion dollars in 2022. But with markets on the brink of a recession, debt financing presents unique, new challenges for organizations.

Image Source: Federal Reserve: Debt of Non-Financial Sectors, 1952 – 2022

Now, more than ever, lenders are scrutinizing business models, projections, and how businesses use their funds to sniff out any whiff of insolvency or potential for default down the road. Gone are the days when a strong balance sheet, compelling product, and lucrative growth metrics could secure a loan. In short, it’s not enough to say you’re the next Uber or Facebook and support with growth metrics to match.

Lenders have tightened the screws and their belts, seeking a holistic understanding of a company’s operations and financial health. To make matters worse, rising interest rates and the closure of regional banks that know your industry well (like Silicon Valley Bank and First Republic Bank) make loans even harder to find and less affordable than ever.

The combination of these dynamics makes it harder for your business to access new debt, putting more pressure on your Finance and Accounting teams, already burdened by existing debt, to figure out the best way to stretch company dollars and resources. Accounting plays a leading role in helping your company survive and thrive while keeping debt and capital in check.

Adapting to market constraints with better financial reporting

To help your company succeed in a market downturn, Accounting must create accurate, verifiable financials and support leadership in making the right trade-offs to pay down raised debt and interest payments. These trade-offs may include prioritizing paying off existing interest payments and satisfying existing customer obligations instead of funding innovation and research projects. Unfortunately, this might also hamper hiring or result in layoffs as well. Accounting needs to adapt to inform the right decisions around reductions, whether in budget or headcount, meaning that you’ll need to rethink your data management and reporting strategy.

But why? Quarterly and annual reporting has been good enough for us over the past few years, and we already struggle to close books within those timeframes. Given the current market, banks and lenders often require more frequent updates on a company’s financial performance. Quarterly financial reporting is no longer enough, with some lenders expecting reports every 30 or even every 15 days. This increased demand for real-time data from your lenders means that your Accounting team needs to gather, analyze, and report information quickly and accurately.

Adapting your accounting team to the change

Lenders and investors require timely and accurate financial information. However, most companies have distributed transaction data spread across multiple systems. To add more pressure on you, debt covenants require you to provide compliant financial reports more regularly, sometimes even weekly or bi-weekly, to ensure your business is still able to pay off its debts.

To satisfy these burdensome debt requirements, your Accounting team needs to put more controls in place and take ownership of the data. Some ways to get there include:

- Moving your teams towards a close every two weeks or once a month.

- Scrutinizing and auditing your numbers before closing to ensure your financials are auditable and accurate.

- Getting intimately familiar with the data powering your financials to have more informed conversations about budgets and revenues with other departments.

- Adopting more automation technology and workflows to unburden your team from manual work and reduce human errors. These workflows should include a method to centralize your data and automatically apply the right accounting rules and principles to your revenues. This way, your team spends less time doing manual calculations or jumping through hoops to get the data you need.

Orienting your team around these goals will help you succeed in the high-stakes world of debt financing, help your company uphold debt covenants, and maintain financial business stability. And, to get there as an Accounting leader, you need accurate and insightful financial reporting and a deep understanding of your organization’s financial health to secure debt under the best terms and pay it off. By staying informed, proactive, and adaptable, you can effectively steer your Accounting team and organization through debt financing challenges and secure a strong financial future.

Chat with one of our experts to learn how you can satisfy your debt obligations with a faster close and accurate, detailed financials.