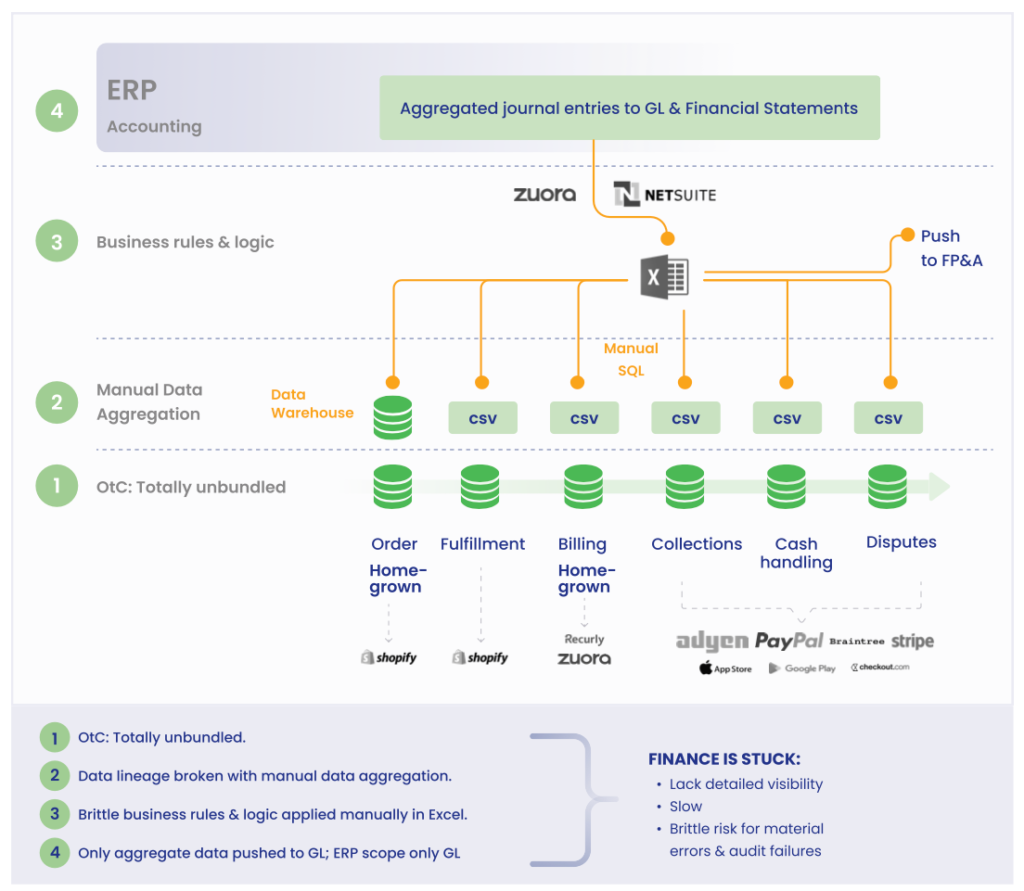

20 years ago, business models were relatively straightforward and finance data was kept in one, centralized repository — an ERP.

As business complexity and transaction volume grew to previously unreached heights, ERP’s role in order to cash unraveled.

Once rigid, monolithic systems were unbundled into software services like order management, payment processing, billing management, and many others. ERPs were left to pick up the pieces, literally and metaphorically.

Order to Cash challenges keep multiplying and that’s causing a domino effect

In fact, the proliferation of operational data sources meant that ERPs were kicked out of the Order to Cash process almost entirely. Rather than being the system of record for Order to Cash, they became just the system of final records for the general ledger.

To make Order to Cash work to process and get paid for orders…, engineering teams have worked hard to stitch these distinct software systems together. But their focus has been on the business process itself, not Finance’s reporting and monitoring of it.

As a result, Finance teams are still largely unable to figure out how to connect the dots between operational and finance data. And that has made for an unholy mess.

Finance is a stressed out scorekeeper

Imagine a basketball game where every player keeps their own score, rebound count, and shot clock. At the end of the game, the scorekeeper collects slips of paper with illegible handwriting from every player with their self-reported stats and tries to figure out the final score. That’s the challenge that Finance teams face figuring this all out.

But it’s even worse that that. Now imagine a tournament where, as soon as one game is finished, the next one starts. But there’s still only one scorekeeper. So during each game, they’re frantically trying to finish figuring out the score for the last game and can’t pay attention to the current game right in front of them. And the players from the last game are getting antsy because they want to know the result and which team to prepare to play next based on the bracket.

That’s one stressed out scorekeeper!

Stop keeping score, and get in the game

But there’s a better way to run your finance operations by elevating your role from scorekeeper to player-coach, that leverages your finance data to come up with strategies to succeed in your next game and win the tournament. However, getting there requires Finance to rethink the Order to Cash process entirely to transition from keeping score to playing the game.

Our e-book focuses on the causes and consequences of a siloed Order to Cash process and how to address these challenges to help your Finance team drive future business success. Built upon insights from hundreds of Finance teams like yours, this e-book outlines the seven pitfalls of the OTC process and how to break free and transform your finance operations.

Get your copy here. And if you’d like to consult with a Finance expert on our team with experience in transforming the OTC process at many companies, schedule a call today!