Stripe NetSuite integration in Leapfin

View the journey of every transaction by combining Stripe events with other operational data — like other PSPs, order management, billing, and other systems — in Leapfin, your source of truth for every transaction.

Accurately recognize revenue and automate ledger entries into NetSuite’s general ledger. Say goodbye to half-baked APIs, third-party connectors, or homegrown integrations. Leapfin turbocharges your Stripe transactions for faster analysis and close.

Here's how Leapfin makes your Stripe Netsuite integration easier

Accurate reporting and analysis with real-time transaction insights

Without an accurate view of every transaction’s journey, you can’t uncover ways to increase profits. How much tax are you I remitting for disputed transactions? Are you offering too many discounts

Answer these questions with Leapfin. Leapfin combines Stripe events with other operational data, converts the transaction data into a universal Financial Record for easy segmentation and analysis, and automates ledger entry creation for reporting.

So, when you integrate it into NetSuite, you capture and analyze every dollar without missing a cent.

Reconcile differences automatically

Dozens of events flow through Stripe daily – from payments to disputes to disbursements. But you still have irreconcilable differences and mistimed transaction reporting.

Why? Because part of the transaction lives in other systems which don’t observe similar immutability, the transaction might fall into the wrong period.

Leapfin automatically combines Stripe events with other transaction activities, assigns each activity to the correct period, and pushes fully reconciled entries into NetSuite. No more funky accounting or manual workarounds.

Pre-built logic for accurate financials

Sure, you can manually calculate foreign exchange rates or different tax rates across multiple journal entries.

Or, you could use Leapfin to apply these calculations, automatically create ledger entries, and push them into NetSuite, all without any manual effort. It’s up to you.

Easy, pain-free audits with traceable transaction linking

Remember when audits meant filling in the gaps in the transaction story between billing and payment? What happens if you invoiced a user a few months ago and reinvoiced them a week ago because of a dispute?

Leap into the future, track transaction data changes, and link related activities together and back to their source. Answer auditor questions in minutes, not days.

What you get with Leapfin, Stripe, and NetSuite

Synchronize Stripe payments and charges with data in other operational systems and view a unified Financial Record that shows the whole transaction journey.

Track data sources in Leapfin for easy audit.

Apply logic like tax, foreign exchange, adjustments, and revenue recognition for quick segmentation and analysis

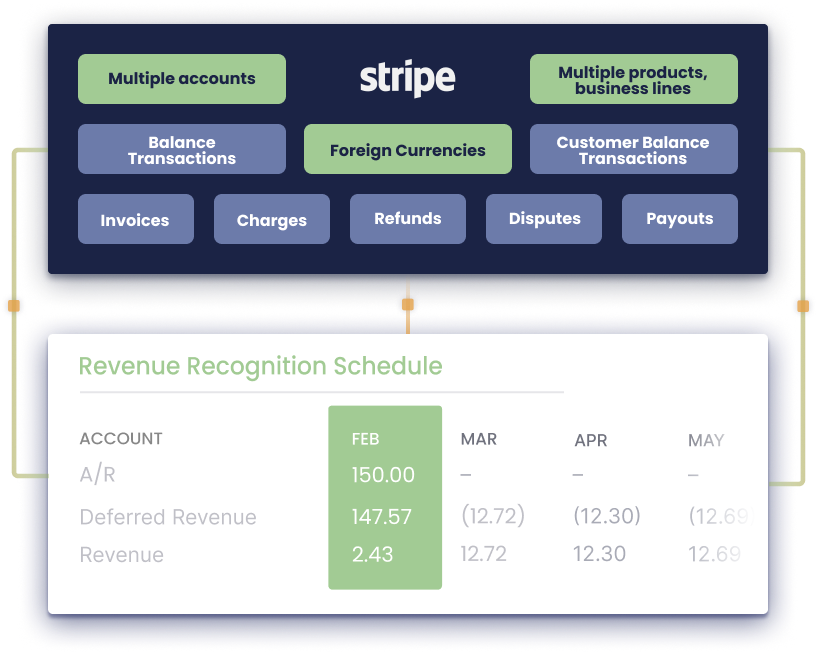

Leapfin fetches the following objects from Stripe: Invoices, Charges, Refunds, Disputes, Payouts, Credit Notes, Balance Transactions, Customer Balance Transactions, Fees, Fee Refunds, Transfers, and Reversals.

View real-time transaction data updated daily and automatically upload Financial Records into NetSuite

Connect multiple Stripe accounts to Leapfin.

Set immutable accounting period parameters and apply them to Stripe data to ease reporting

Extensible platform that handles businesses with multiple subsidiaries, business models, different currencies, and thousands of daily transactions, even during peak seasons.

See Stripe data process in real-time, automatically detect data errors, such as missing fields and invalid values, and view recommendations on fixing them.

-

Leapfin is our valued partner for revenue recognition. All of the PSP data that we need for the month-end close lives in Leapfin and gets updated in real-time.Emily Eagon Controller @ Medium

Automate your journal entries at scale with Leapfin

FAQs about the Stripe Netsuite integration in Leapfin

Leapfin offers a native Stripe integration, fully configurable to the data you want to pull, whether it’s charges, refunds, disputes, payouts, or anything else. Leapfin integrates Stripe with NetSuite using a four-step process:

- Leapfin synchronizes Stripe payments and charges with data in other operational systems, creating a unified Financial Record that tells the whole transaction story. Leapfin turns this data into automated journal entries.

- Leapfin applies business logic, like tax rates, foreign exchange rates, or linear revenue recognition schedules to the entries.

- Leapfin automatically converts journal entries into ledger entries.

- Leapfin pushes those entries into NetSuite ERP using Leapfin’s native NetSuite integration without additional APIs or connectors.

Users can use Leapfin data linking to trace ERP general ledger entries to the Stripe reports and related transaction activities in other systems (order management, billing, etc.).

By integrating Stripe with Leapfin, rather than directly with NetSuite using an API or connector, your team can achieve the following benefits:

- Make sure everything is reconciled automatically with Leapfin before it goes into the ERP.

Create a clean revenue subledger in Leapfin that’s flexible and immutable, letting the NetSuite general ledger summarize the dimensions that matter. - Save millions of dollars by not pushing thousands of transactions into NetSuite storage. Store the individual transactions in Leapfin and then create ledger entries that you can push into NetSuite to save money.

- Avoid slowing down NetSuite’s ERP with large data volumes by using Leapfin’s extensible graph architecture. Leapfin can handle millions of transactions without slowing processing.

- Avoid dealing with common errors associated with a high transaction volume integration, like blocked transactions, data re-runs to complete a transaction record, and API warnings. If Leapfin spots an error in your data, it will flag it for you and recommend how to fix it without re-running your data.

- Support your digital business with a flexible platform built on graph architecture with Leapfin. Avoid friction caused by mapping complex product system data models to NetSuite objects since NetSuite’s relational database can’t support them.

- Create an immutable record for Stripe source data to avoid risk issues between periods. Also, avoid the risk of posting transactions to the wrong period. Leapfin automatically allocates transaction activities in the period in which they occurred.

How? In four steps:

- Leapfin enriches Stripe data with transaction data from other operational tools, providing the journey for every transaction in a unified, immutable Financial Record.

- Leapfin creates journal entries that reflect the journey of every transaction.

- After applying accounting logic to the entries, Leapfin automatically converts them into ledger entries.

- Finally, Leapfin pushes these fully reconciled ledger entries into NetSuite general ledger.

And the best part? Leapfin automates this process without extra manual effort, whereas APIs and connectors often require costly engineering resources to configure.

Integrating Stripe with Leapfin requires four easy steps. Here’s what you need to do:

- Evaluate the number of Stripe instances your business has and connect your Stripe accounts to Leapfin.

- Integrate Stripe events — like charges, disputes, and payments — into Leapfin to reflect every Stripe activity in Leapfin.

- Integrate other operational tools — payment service providers, billing systems, order management systems, and mobile payment applications — with Leapfin to view the journey of every transaction.

- To view this data in your ERP, integrate Leapfin with NetSuite.

That’s it!

The Stripe-Leapfin integration covers an expansive, out-of-the-box list of scenarios and automation based on your business needs. See our documentation page to see the scenarios we can support.

The NetSuite API limits don’t constrain Leapfin. Leapfin captures and enriches data from Stripe with other transaction data using a flexible, expansive architecture. This architecture can support rapidly scaling transaction volumes without slowing data processing or involving extra engineering.

Also, the Leapfin – NetSuite integration reconciles journal entries daily. However, the increased volume doesn’t slow down data processing because Leapfin pushes the aggregated data to the trial balance in NetSuite.

See our Integrations page for our complete list of systems we can integrate. Leapfin’s flexible architecture can support multiple integrations with the following tools:

- Payment and billing tools like Shopify, Braintree, Amazon Pay, Paypal, and Adyen

- Mobile app stores like Google Play and Apple App Store

- Subscription billing tools like Zuora, Chargify, and Recurly

- Homegrown custom solutions.

Most of our customers integrate Leapfin with more than one payment system. Then, you can easily integrate with downstream reporting and analysis systems like NetSuite, Looker, and Tableau.