Connect and transform siloed transaction data hidden into reportable financials and actionable insights with Leapfin.

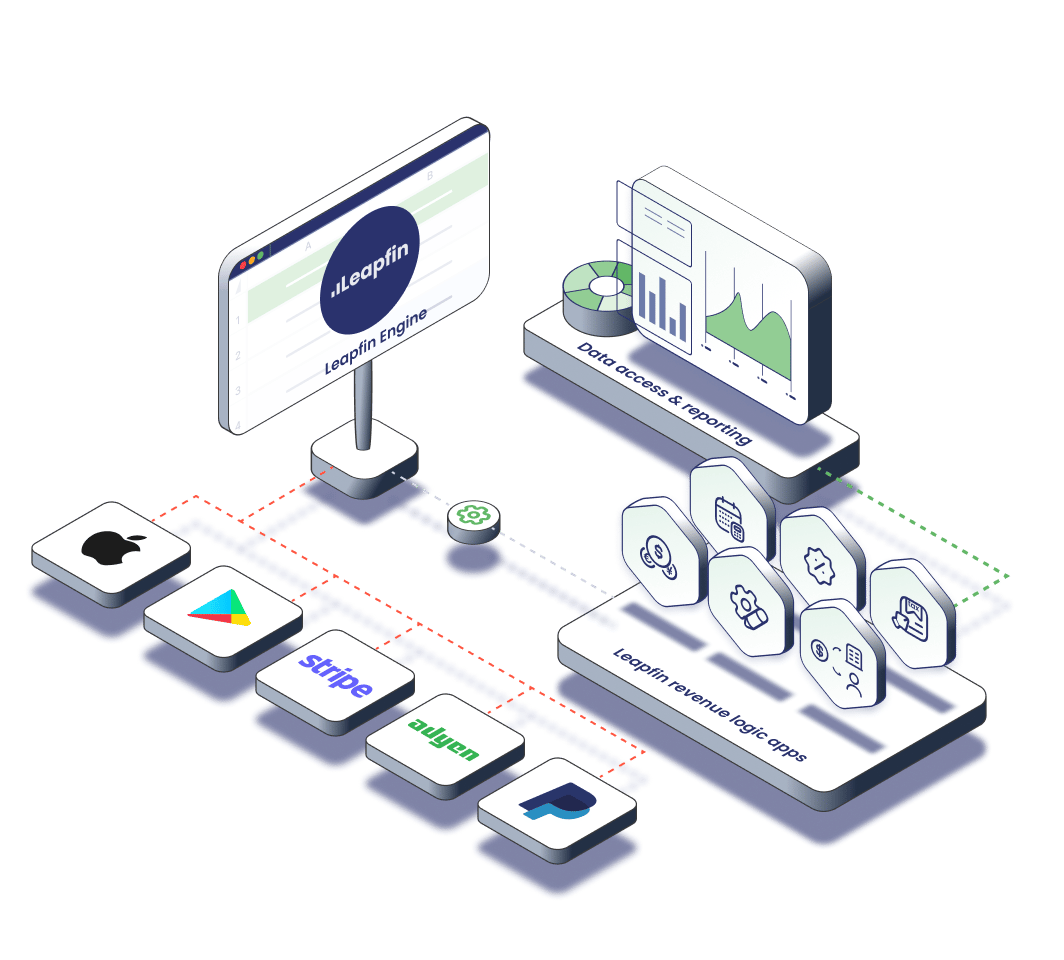

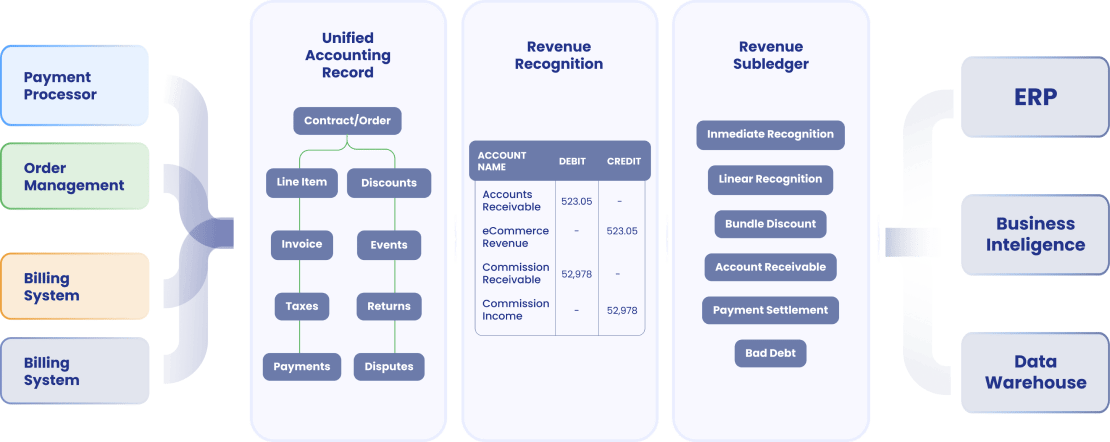

Leapfin’s revenue accounting automation platform is designed to handle millions of transactions and transform them into accounting records, journal entries, and subledger accounts.

Built with Finance teams in mind, Leapfin is built upon a flexible, transparent data model that centralizes, standardizes, and establishes relationships across millions of transactions and transforms them into reportable financial records like journal entries and subledger accounts. Close your books in minutes, not days, with transparent, actionable data.

Leapfin applies its data model to two crucial events in the accounting process: the Accounting Record Graph (transaction data transformation) and Revenue Accounting.

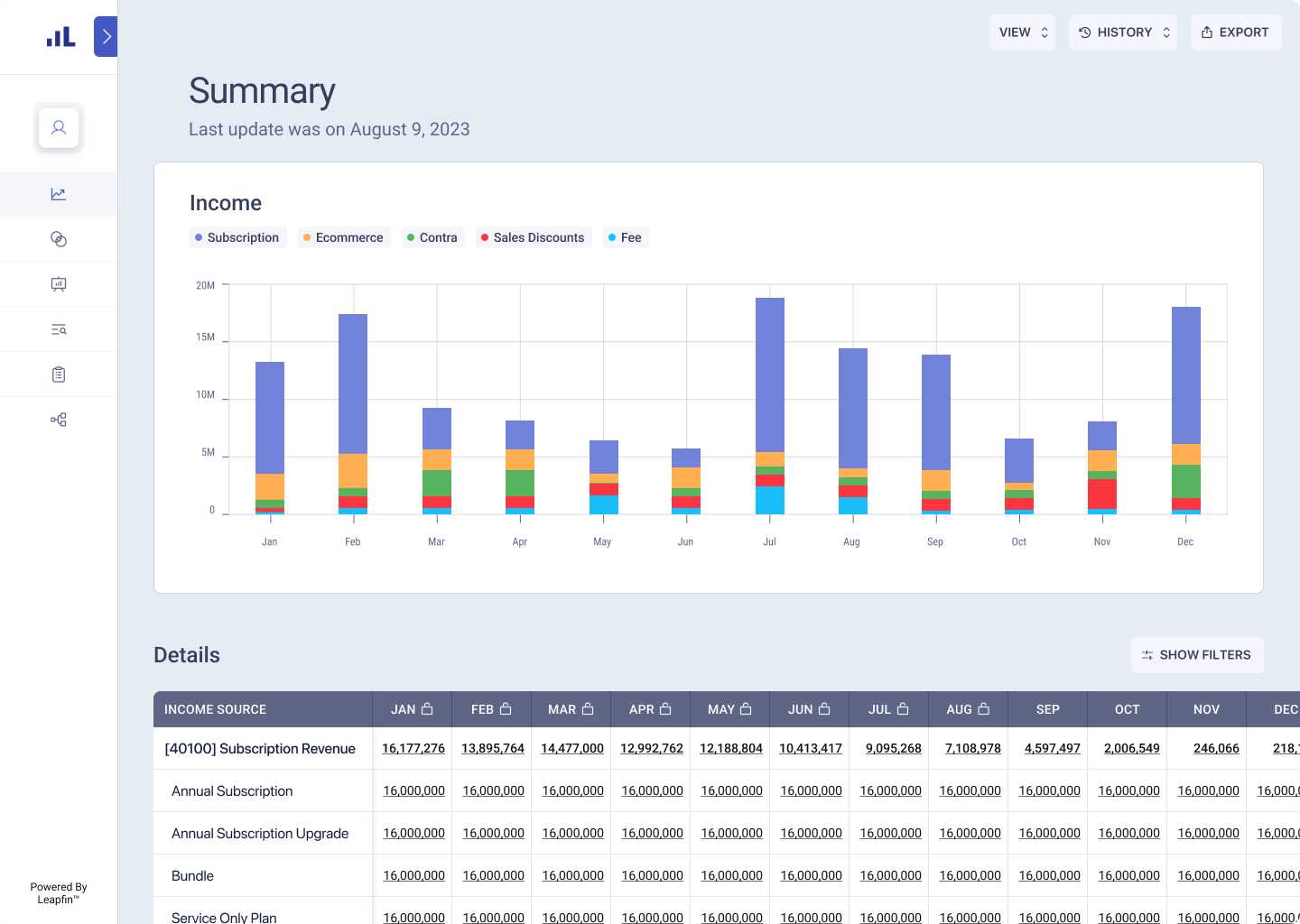

Close books continuously with real-time data. Leapfin extracts data from your transaction processing systems daily and enables you to see the data process in real-time.

Integrate your transaction processing and financial reporting in systems in Leapfin for complete visibility into your transactions and to streamline the accounting process.

Lock accounting records and journal entries to ensure new transaction data doesn’t overwrite historical data crucial for accurate reporting.

Protect valuable revenue data in Leapfin’s SOC 1 and SOC 2 Type 1-secured platform. View audit logs which highlight the data process and every user activity in Leapfin.