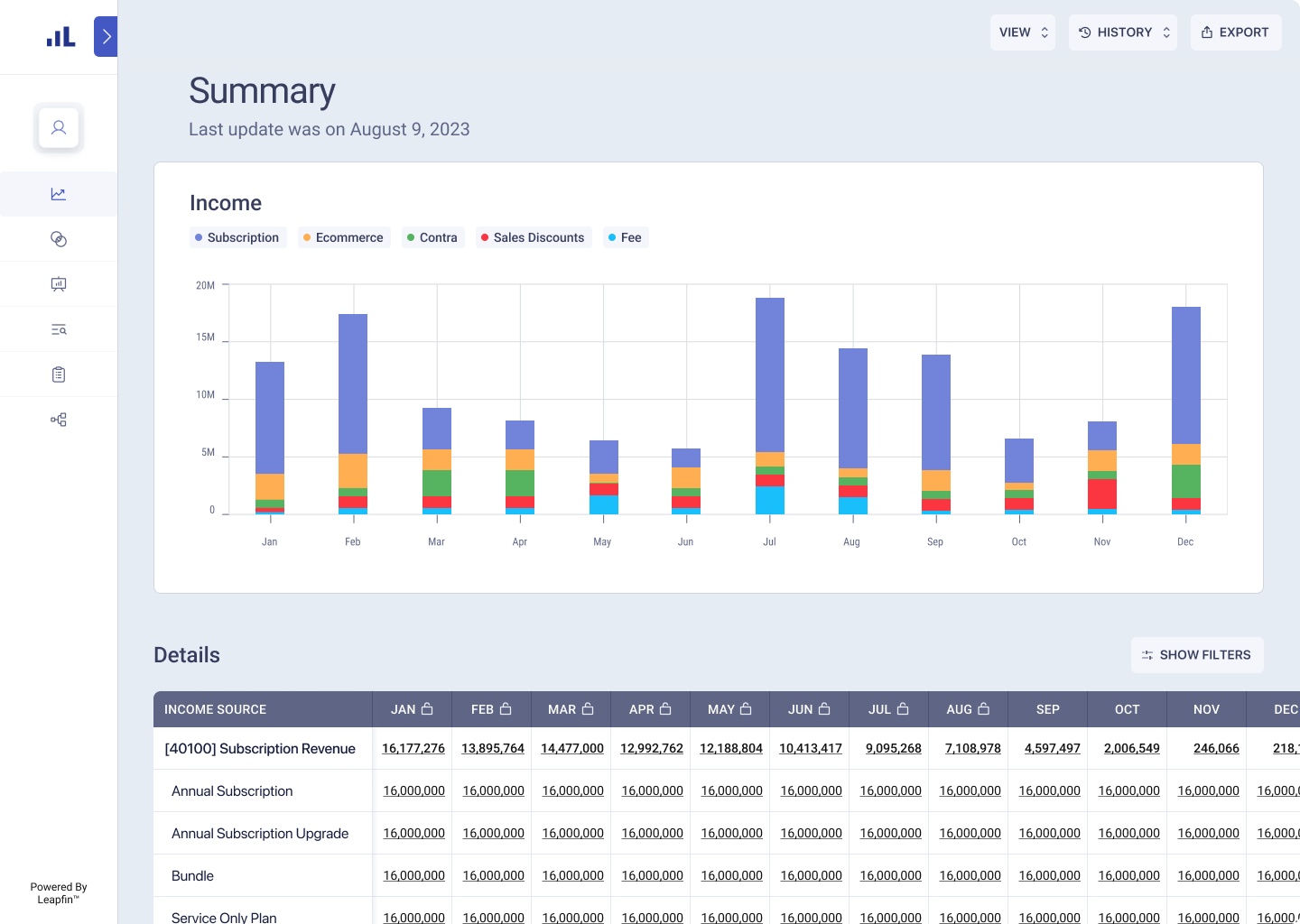

Close revenues in less than 2 days, even with millions of pass-through transactions, with centralized revenue accounting automation.

With millions of transactions passing through your marketplace daily, it can be hard to keep up and close books given their volume and complexity. Leapfin automates revenue accounting by consolidating and transforming transactions into a detailed, reportable format and layering revenue recognition and subledger workflows on top. Eliminate manual accounting so your team can focus on acting on the data.

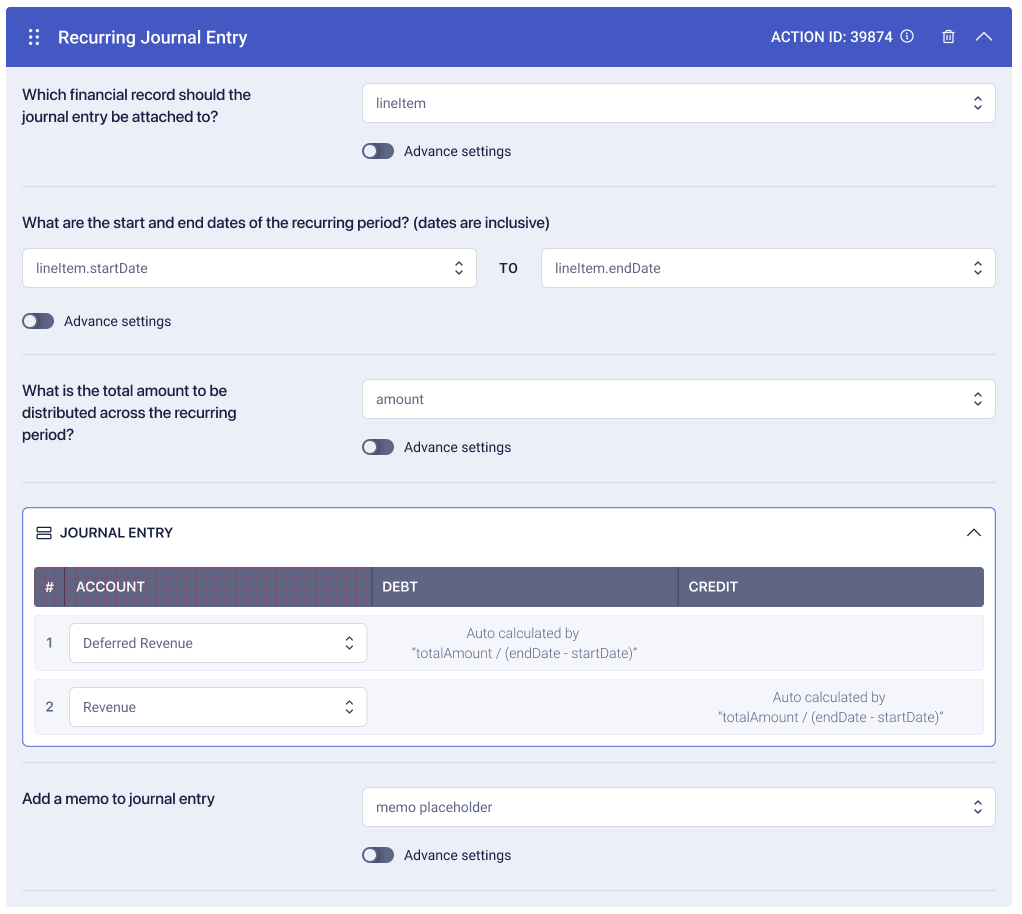

Alleviate the headache of manually applying compliance standards to millions of complex transactions. Report consistent, accurate revenues in Leapfin with pre-built ASC-606 and IFRS-15 compliant revenue rules. Drill into the subledger to check for compliance and see the rules applied. Confidently report compliant revenues, without hefty spreadsheets.

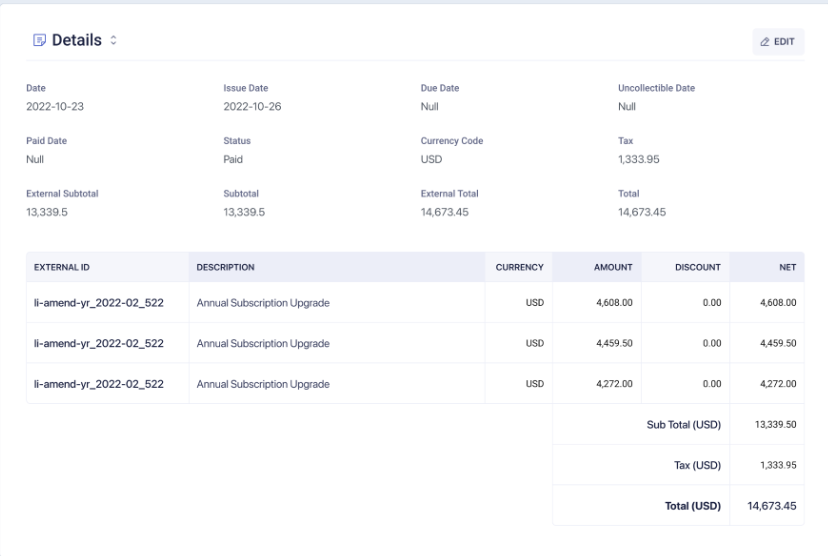

Help auditors easily follow the money and verify financial data accuracy, hand them Leapfin. Leapfin provides easy-to-validate, traceable, and accurate revenue numbers by centralizing the entire accounting process in one place. This way, auditors can see how dollars flow through your business from source data to the subledger.

Bring on more sellers and products without re-engineering your ERP or breaking your accounting software. Leapfin’s flexible architecture can easily expand to handle more complex transactions and hundreds of millions of transactions without slowing the close process. Report on revenues passing through your marketplace daily.

Demystify revenue data by consolidating your transactions and accounting processes into a single system of record – Leapfin. Help your organization gain a better, more complete understanding of customer behaviors and revenue trends with centralized transaction data. Help your business make better strategic decisions with easily accessible, complete, accurate, and detailed transaction data.