Adhere to Regulations With Ease

Increase confidence in your numbers by automating compliant accounting.

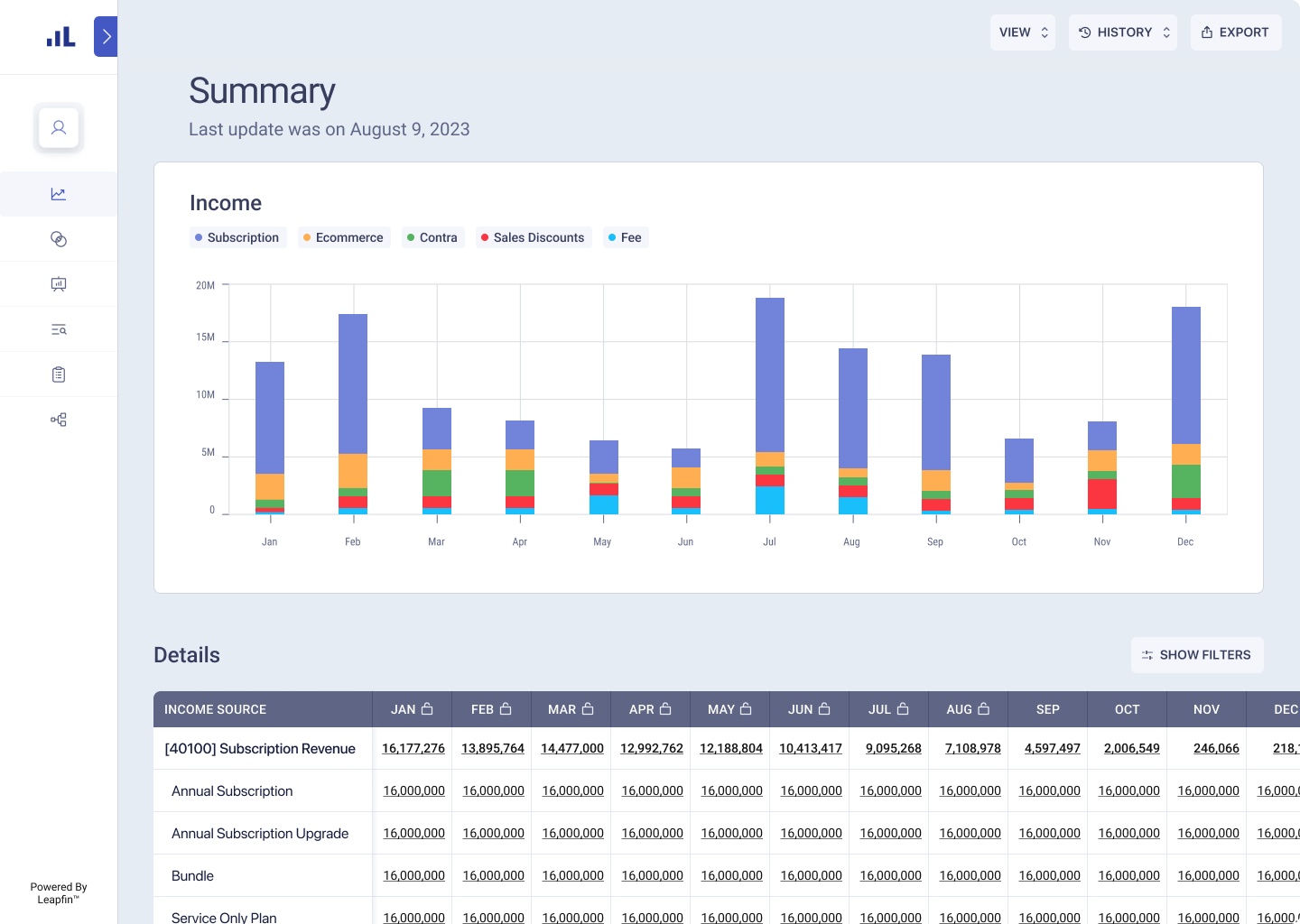

Report accurate, compliant financials

Limit data handoffs and manual intervention that can expose your financial data to compliance risk and potential errors. Centralize transactions in Leapfin, automating revenue rules, recognition, and subledger creation for accurate, compliant, and verifiable numbers. Adhere to regulations without opening up a spreadsheet.

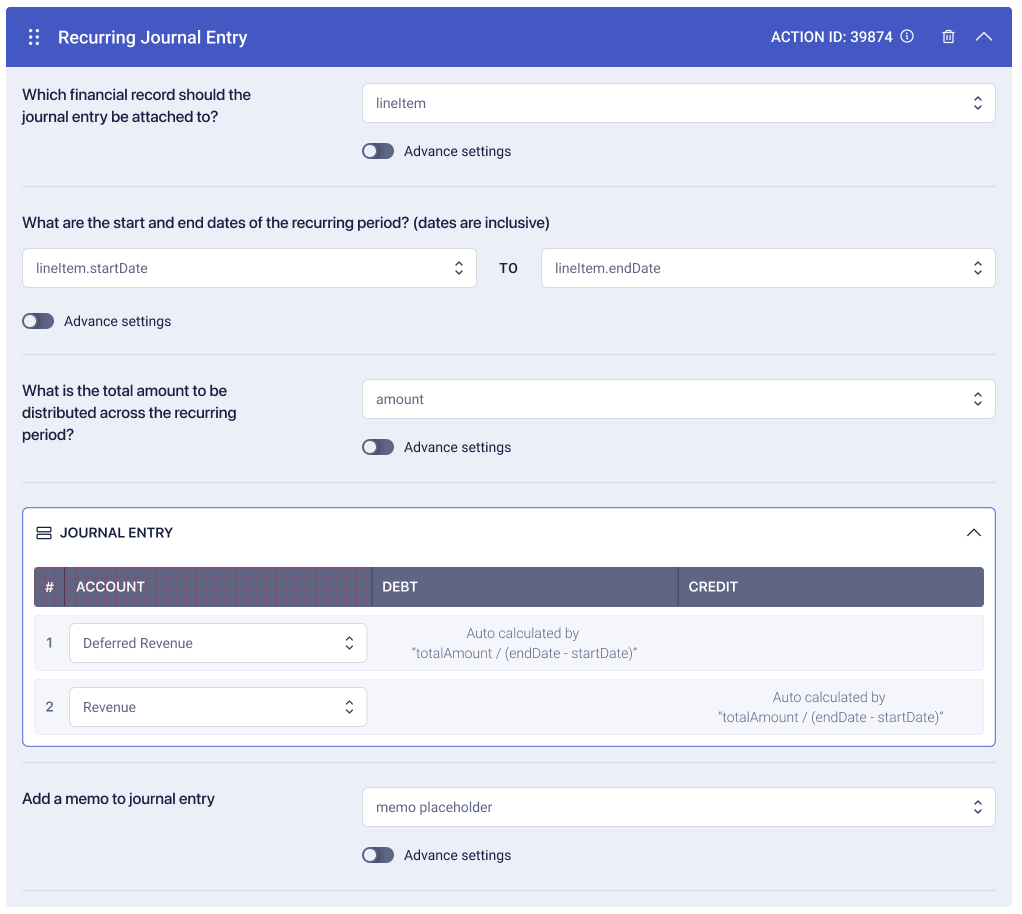

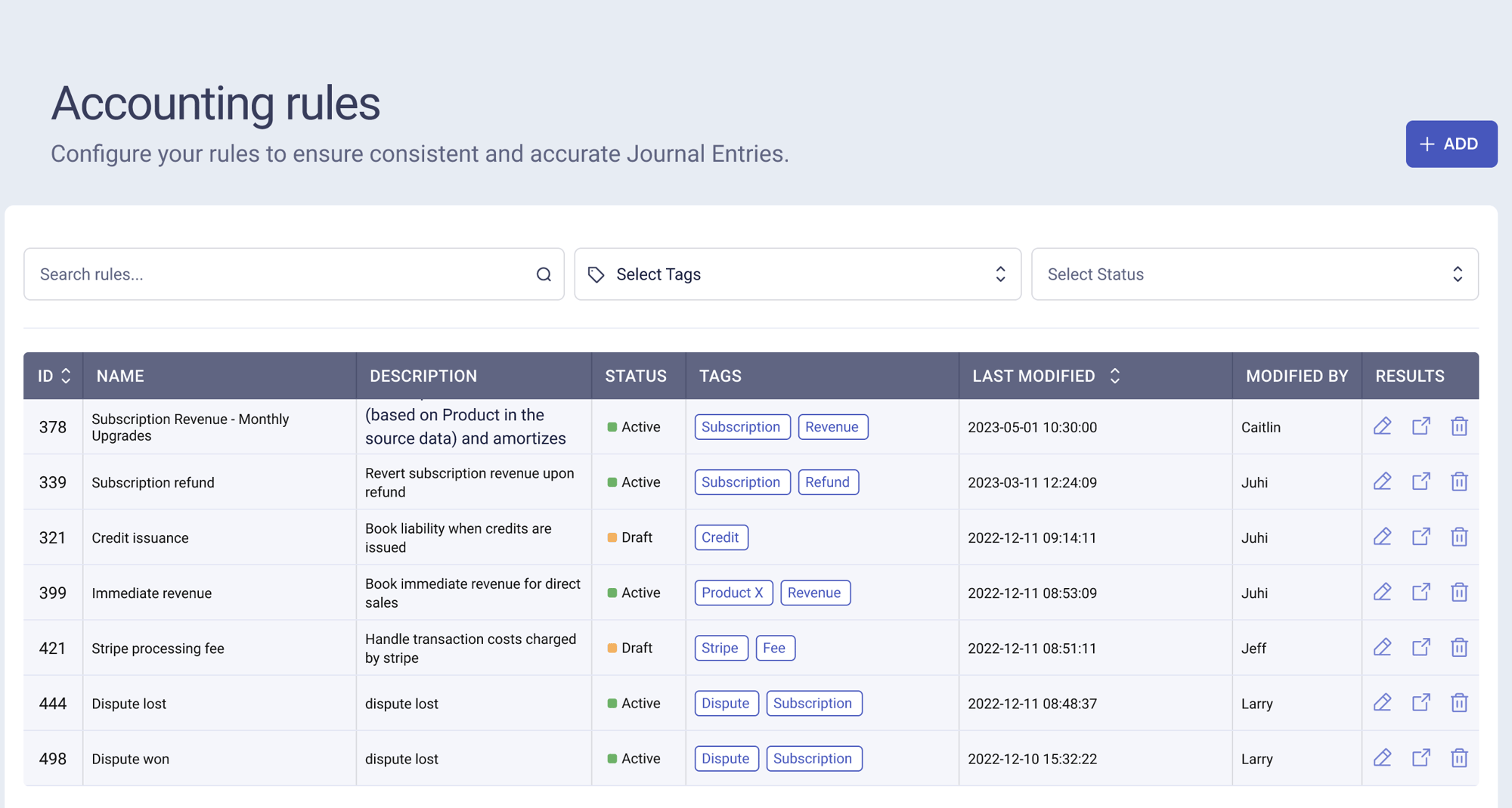

Minimize risk with compliant revenue rules

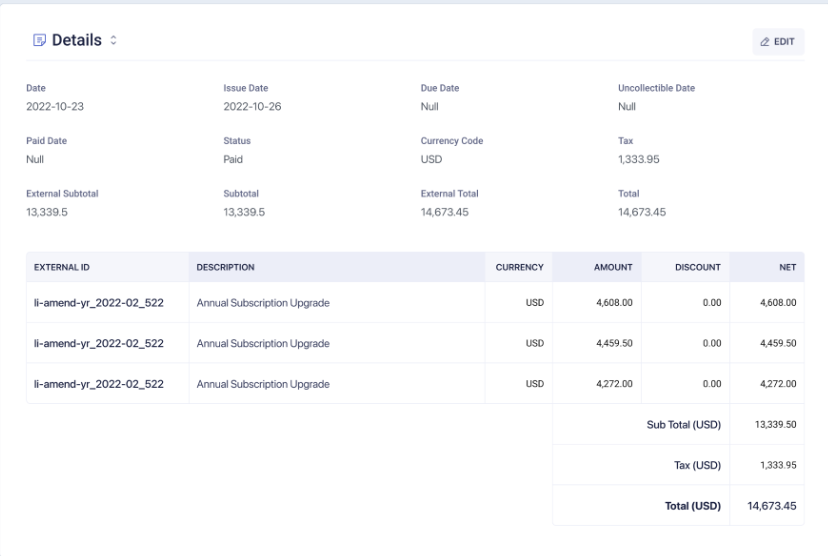

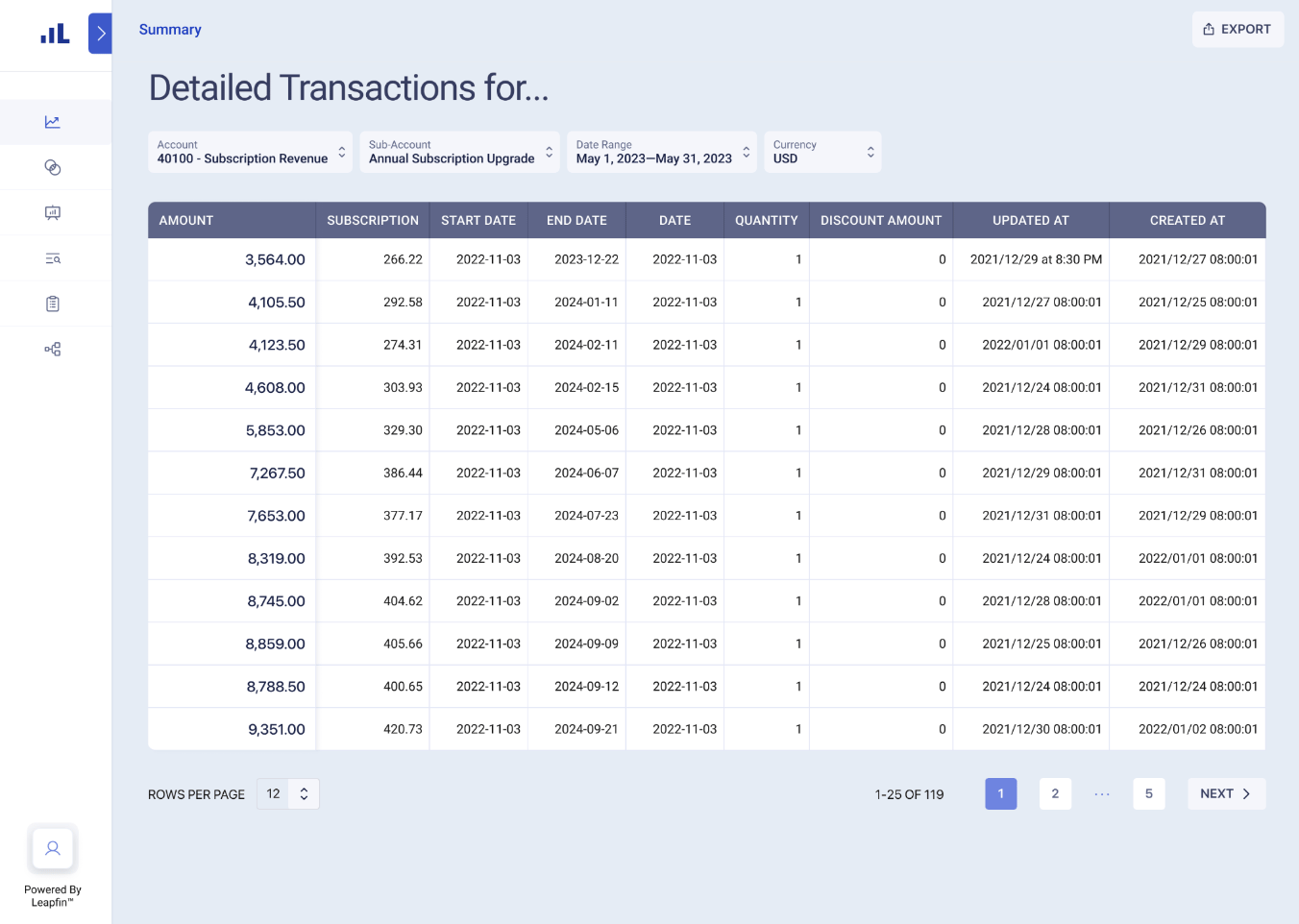

Automate revenue recognition in Leapfin to minimize the risk of misstatements. Create and apply consistent ASC-606 and IFRS-15 compliant revenue rules across all transaction records for accurate, compliant, and consistent accounting. Trace subledger accounts to source data and view documentation of intermediary steps. Stay compliant and audit-ready at all times.

Streamline audits with traceable, transparent financials and rules

Conduct efficient audits with accurate, compliant, traceable financials in Leapfin. View compliance rules applied to each record and drill into subledger accounts to view detailed documentation of every step of the accounting process. With Leapfin, audits are headache and stress-free for you and your auditors.

Enhance visibility with consolidated, standardized data and process

Keep your entire revenue accounting process in one place to minimize room for error. Maintain tight control and compliance across records and processes by consolidating and standardizing your raw transaction data and automating the downstream revenue recognition in Leapfin. Enhance data visibility and access with one system of record – Leapfin – to operate efficiently and compliantly.

Respond quickly to changing regulations as you scale

With scale come greater compliance responsibilities. Quickly adapt or update accounting records, even millions of them, to stay compliant with new regulations in Leapfin by creating new revenue rules that you can apply to your data with a few clicks. Evolve as quickly as your business without slowing down for manual rework.

What makes Leapfin different?

Unparalleled accuracy

Report accurate, auditable revenue numbers every time with an automated, end-to-end revenue accounting platform.

Full transaction insight

Audit-ready and traceable

Drill into subledger accounts to the source data – journal entries, revenue rules, transactions, and source systems.

Transaction agnostic

Integrate any transaction type or format from any and all systems and unify them into a unified, consistent, reportable format – the Universal Accounting Record.

Built-in support

We personalize onboarding to your needs, market, and regulatory requirements, getting you up and running, fast. After launch, we’ll stay with you every step of the way with product trainings, ongoing support, and a dedicated specialist.

Secure and reliable

Trust the data and the systems behind it. Leapfin is compliant with SOC 1 & SOC 2 Type 1 standards and operates at 99% uptime. Lock transactions to the period in which they occur to accurately reflect adjustments without fear of overwritten or lost data.

-

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports -

Leapfin has transformed our close process into a seamless experience. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

Leapfin has transformed our close process into a seamless experience. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports -

Leapfin has transformed our close process into a seamless experience. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

Leapfin has transformed our close process into a seamless experience. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit