Close faster and report accurate numbers with centralized revenue accounting automation.

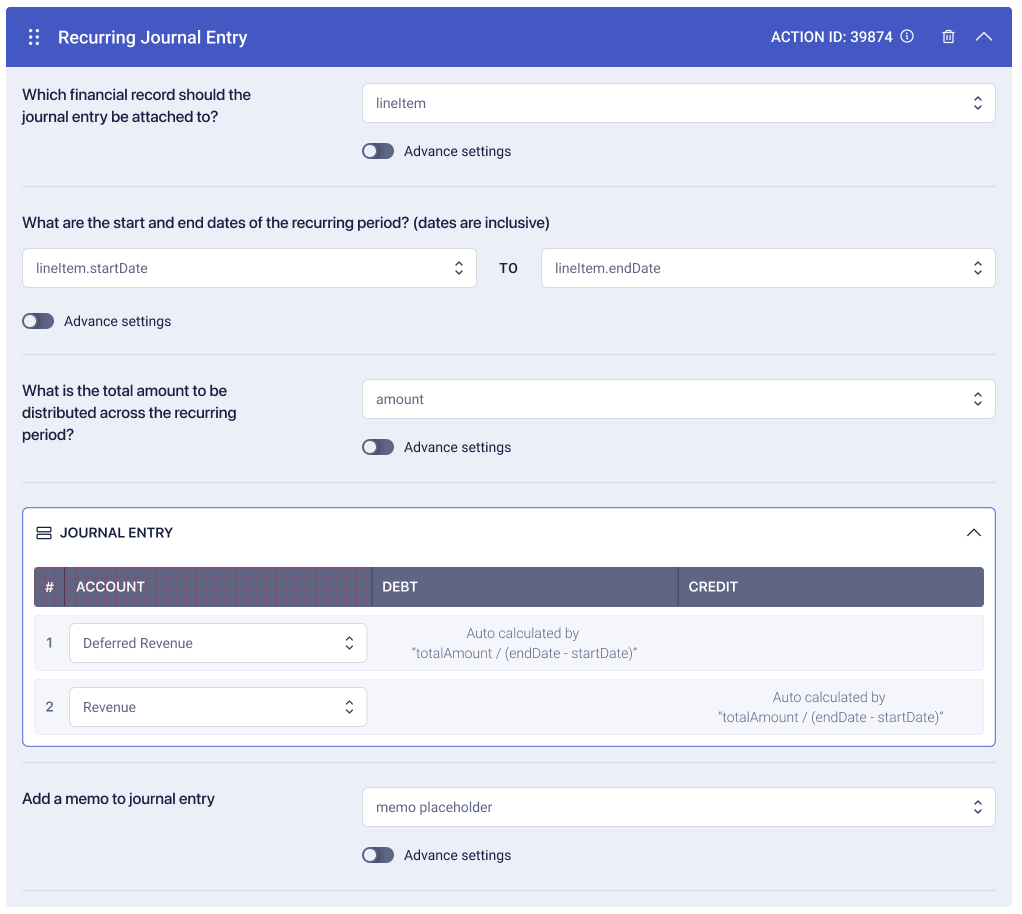

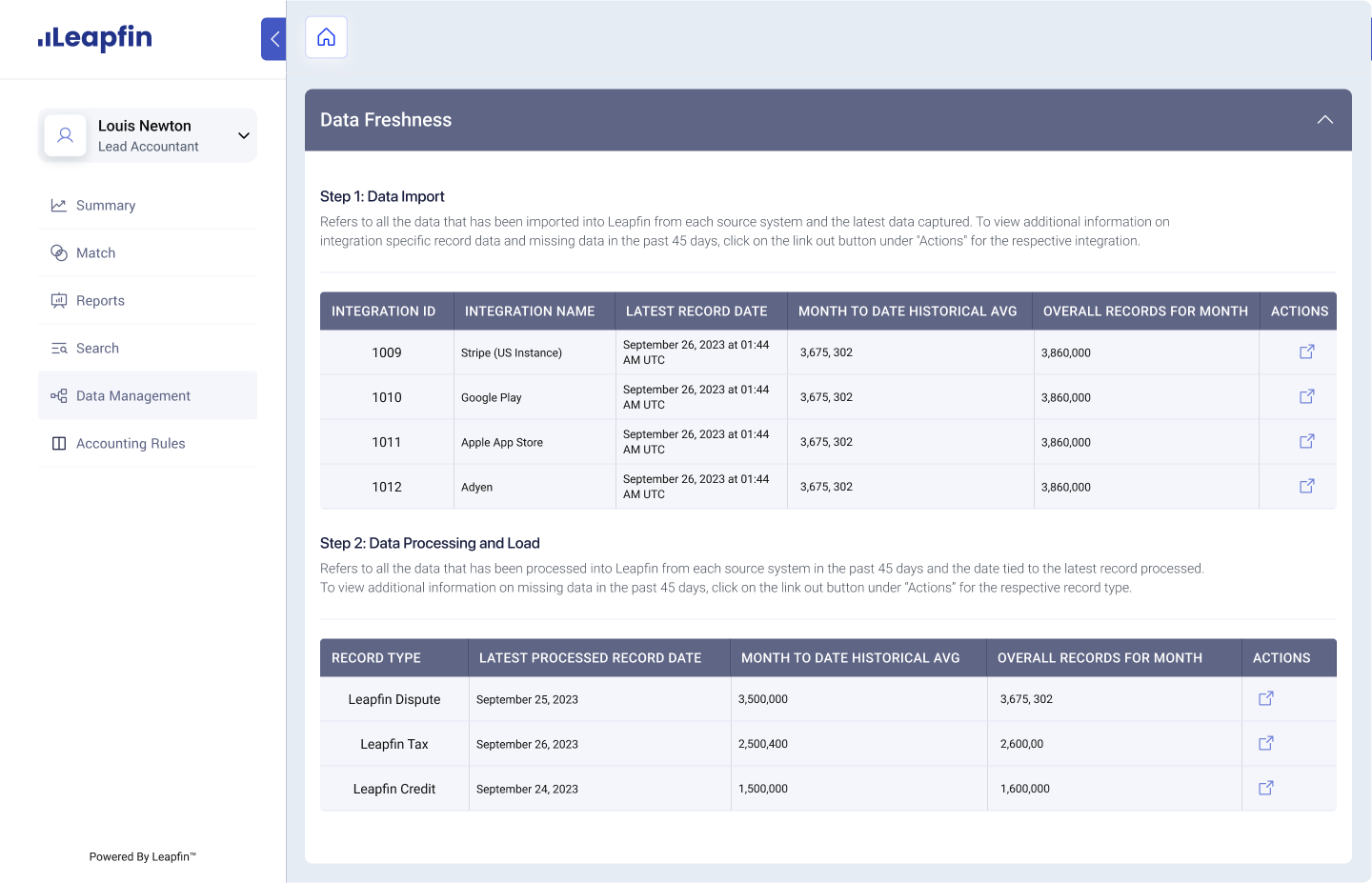

Manually calculating deferrals and adjustments on millions of billing and payment records across multiple products and systems can tank your productivity. Leapfin helps automate revenue accounting by consolidating transactions, transforming each transaction into a detailed record outlining the entire trail, and then automating revenue recognition.

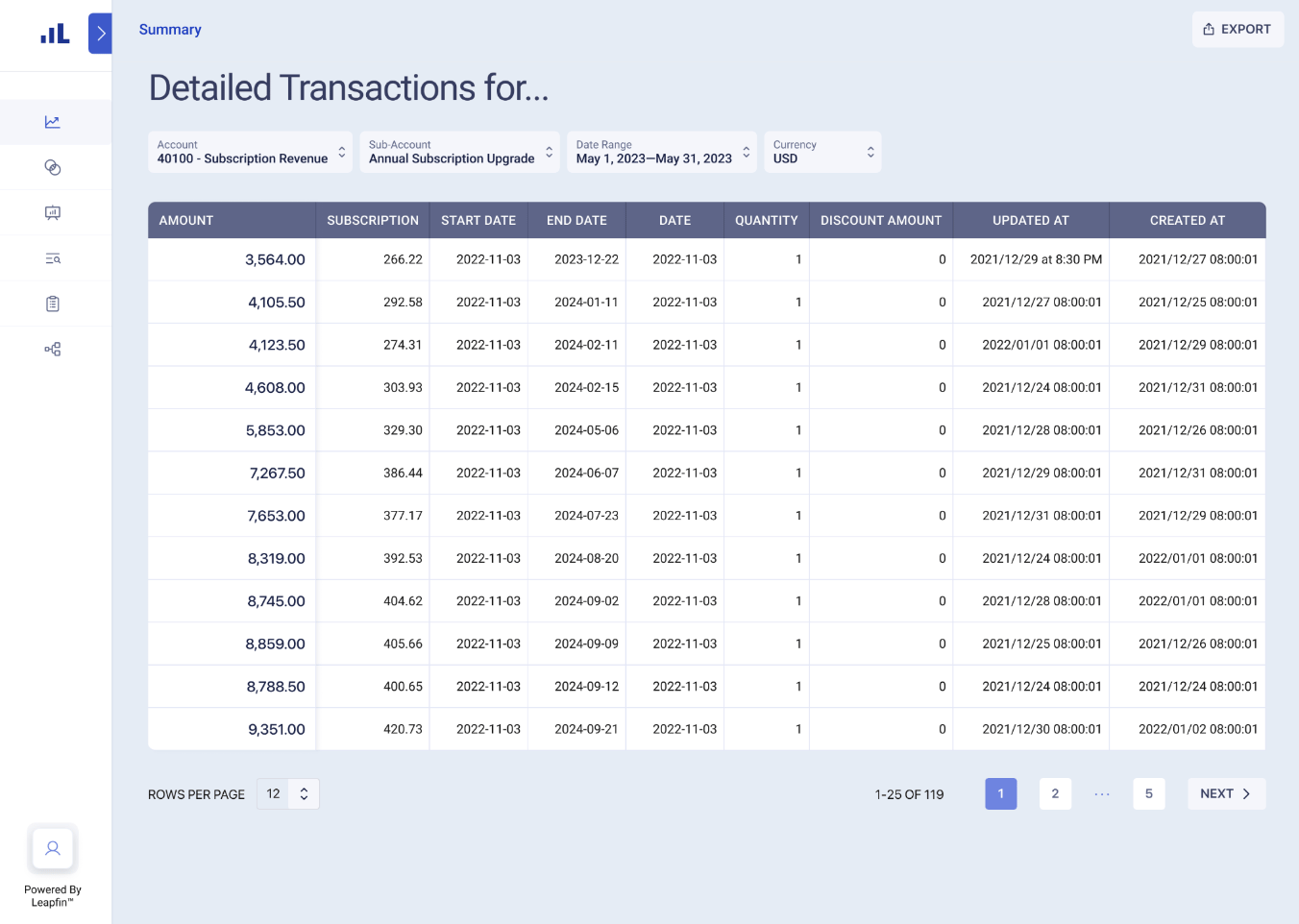

Manually applying compliance standards to millions of transactions can be error-prone and time-consuming. Automatically apply ASC-606 and IFRS-15 compliant revenue rules to transactions with Leapfin for consistent reporting. Drill into subledger records to verify and view the rules applied. Stay compliant without checklists or spreadsheets.

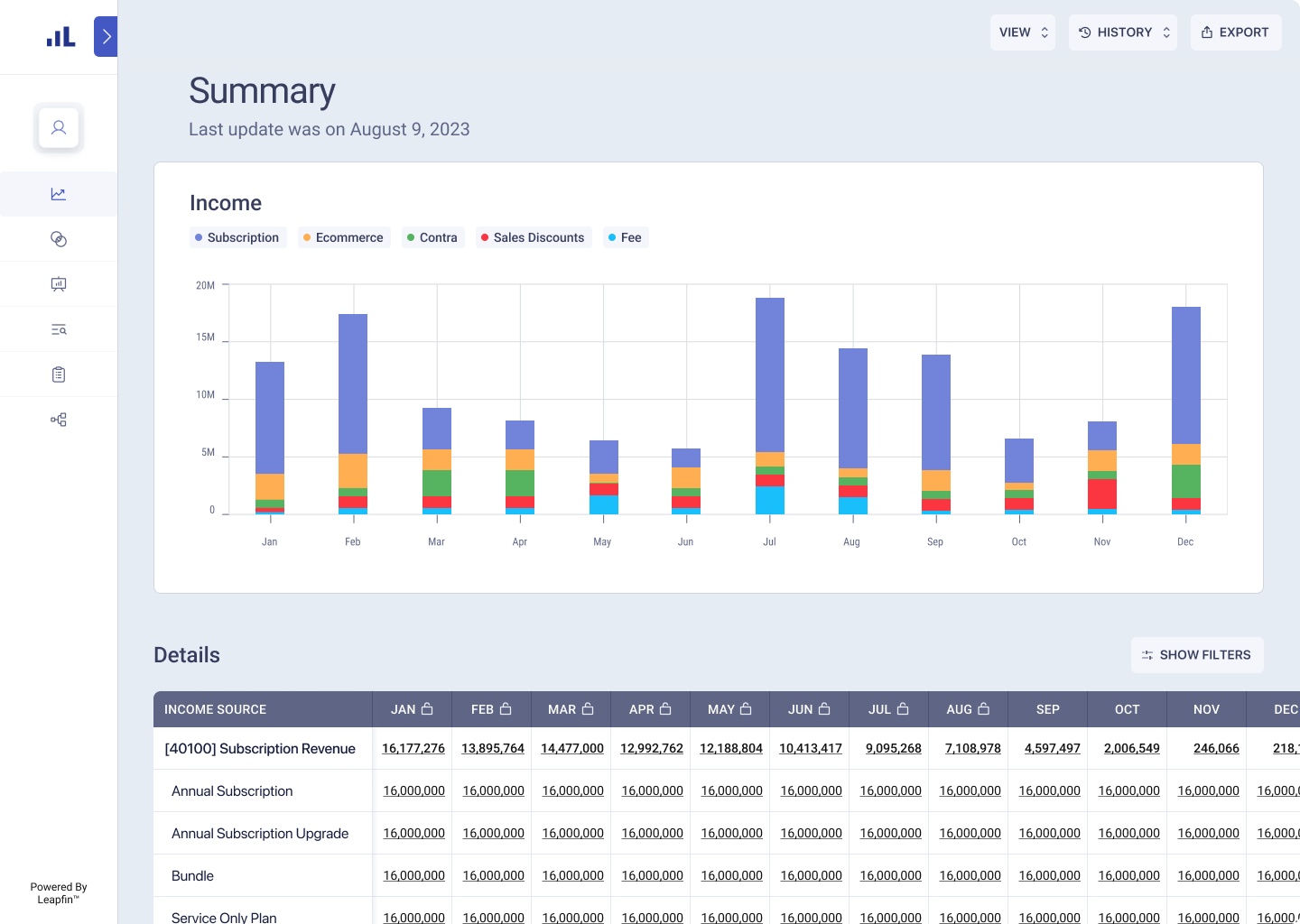

Group transactions by any dimension, such as product, transaction type, or geography, to uncover novel insights and better understand your customers. Uncover trends like increases in bad debt or disputes to improve the customer experience and maximize profits. Forecast more accurately with filtered data and share better, richer insights crossfunctionally.

Grow your customer base and recurring revenues without overextending your ERP or reconfiguring your accounting stack. Leapfin’s flexible architecture can easily expand to handle millions of transactions without slowing down revenue accounting processes.

Breakdown data silos and opaque revenues caused by storing transaction data in multiple systems or in a data warehouse. Consolidate your transactions in Leapfin to uncover novel insights that can help you personalize experiences for your customers. View the entire transaction trail across every transaction without jumping between platforms. With Leapfin as your system of record, Accounting can finally own the revenue truth.