This post is the first of a series of blog posts regarding cash reconciliation for accountants. Below are all topics included in this series:

- An Accountant’s Guide to Order to Cash

- Introduction to Cash Reconciliation

- 4 Reasons Why Accounting Teams Need Cash Reconciliations

- How to Perform a Cash Reconciliation – A Step-By-Step Guide for Accountants

- How to Perform a Cash Reconciliation: A Real-World Example

- 5 Most Common Problems When Performing a Cash Reconciliation

Overview of Order to Cash

Like most Americans, Spotify is my go-to when it comes to listening to music. I recently decided to subscribe to the paid plan on the Spotify streaming platform. During checkout, I was required to input my payment and billing information. Once the checkout was completed on my end, the order was submitted to Spotify. At that point, the ‘Order to Cash’ process for Spotify begins.*

What is Order To Cash?

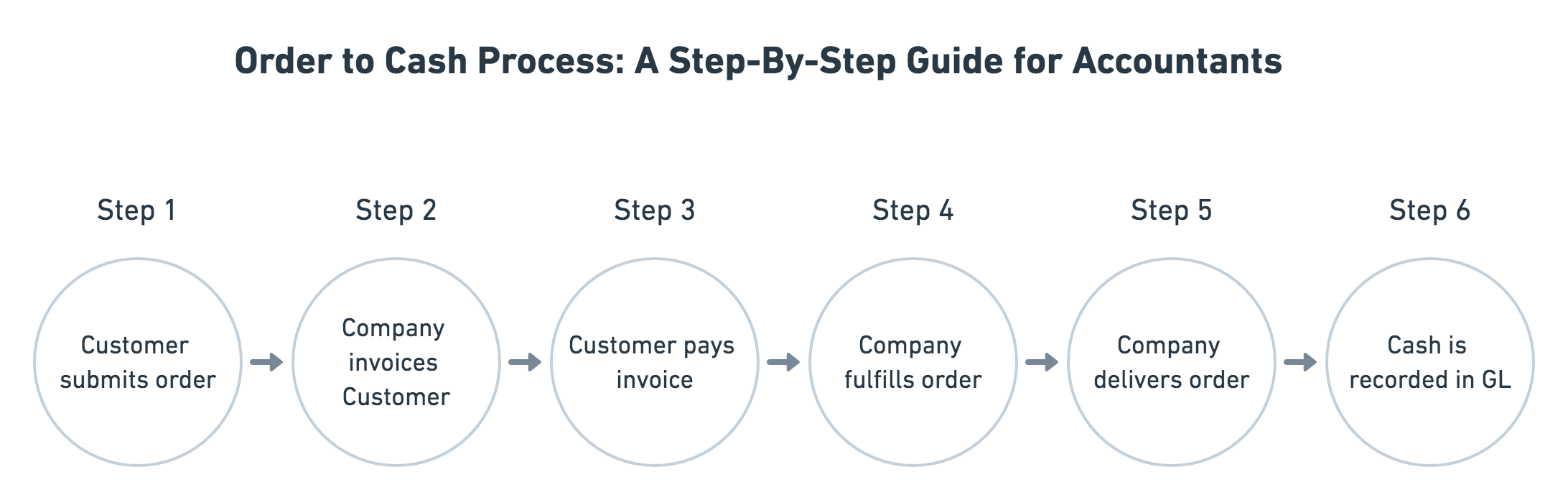

At a high level, Order to Cash (AKA OTC or O2C) describes the procedure for processing customer orders, applying payments to invoices, and matching payments to the cash received in a company’s bank account. The principles behind OTC are essentially the same across all businesses and industries. However, the mechanics and ordering of OTC procedures do vary slightly for subscription and Software-as-a-Service (SaaS) business models.

In this discussion, we will walk through a typical SaaS OTC procedure and review the related journal entries at each step.

Find out if your revenue data is blocking order-to-cash efficiency.

Let’s take a closer look at each OTC step for a SaaS business:

Step 1: Customer submits order

The OTC process begins when a company receives an order. For many SaaS companies with high transaction volume, orders are made directly on the company’s website and immediately processed by a billing or order management system.

Example: On Jan 1, Customer browses Widget Company’s online store and decides to purchase a one-year subscription for access to Widget’s photo editing software for $500 (SaaS).

Step 2: Company invoices Customer

Step 3: Customer pays invoice

The order in which Steps 2 and 3 occur in the OTC process varies by company and operating model.

For high-volume SaaS companies where orders are placed directly through the company’s website, customers are typically required to submit payment digitally before the order can be successfully processed (e.g. A subscription purchase for Spotify). Once payment information is provided, the customer can complete checkout, submit the order for fulfillment, and receive an invoice for the purchase. Invoices should include order details as well as any discounts or taxes, where applicable.

Note: In traditional non-SaaS or enterprise business models, order fulfillment and delivery may occur prior to invoicing.

Example (cont.): The annual fee of $500 for the one-year subscription is collected upfront by Widget Company. At checkout, Customer submits payment via credit card and submits the order. Next, Customer receives an invoice copy via email.

General Ledger Impact:

| Month | Account | DR | CR |

|---|---|---|---|

| Jan 1 | Accounts Receivable* | $500 | |

| Deferred Revenue | $500 |

We will debit Accounts Receivable on the Balance Sheet instead of Cash, as credit card transactions may take up to 3 days to successfully process.

Step 4: Company fulfills order

Step 5: Company delivers order

After receiving payment and invoicing the Customer, the Company must fulfill and deliver the order. For most SaaS companies, fulfillment and delivery occur simultaneously, simply by provisioning access to the software.

Example (cont.): On Jan 1, Widget Company received the completed order and provisions software access to Customer. The customer now has access to Widget’s photo editing software for one year.

General Ledger Impact:

| Month | Account | DR | CR |

|---|---|---|---|

| No impact to the General Ledger. |

Step 6: Cash payment is recorded in General Ledger

The final step of the OTC process is to record the cash payment in the General Ledger and relieve the Accounts Receivable balance that was initially created upon invoicing in Step 2.

Example (cont.): On Jan 3, the credit card payment is successfully processed, and Widget Company receives cash in the bank. The Accounts Receivable balance can now be relieved against the cash received.

Note: Having a cash reconciliation process in place will allow companies to match sales to cash received. This can provide Accounting teams additional assurance that revenue and deferred revenue are properly recorded in the General Ledger.

General Ledger Impact:

| Month | Account | DR | CR |

|---|---|---|---|

| Jan 3 | Cash | $500 | |

| Accounts Receivable | $500 |

Why order to cash becomes difficult and what to do to address that

Optimizing the Order to Cash process should be a priority for every company. Streamlining OTC procedures improves margins and enables businesses with high order volume to scale efficiently. At each step, automation is key to creating an effective OTC process. With that accomplished, opportunities abound to automate closely-related processes such as Revenue Recognition and Cash Reconciliations.

However, that’s easier said than done thanks to the unbundling of a number of operational and finance tools and the different ways they approach handling data.

As Leapfin’s VP of Product Caitlin Steel explains:

There are fantastic operational tools out there and they are designed to do a job and they do that job really well. But they don’t all necessarily consider Accounting and Finance perspectives and goals.

For example, say you want to pull a settlement date from a payment system. Do you know that the settlement date in Stripe isn’t the same as the settlement date in your general ledger? Now you have a record with different settlement dates, so which one is the right one? That’s why I still see people out there doing these reconciliations manually, mostly in spreadsheets.

You really have to navigate carefully to identify which of your operational systems are generating financial information. And it’s very difficult to manage things that way. There’s literally no control over how this information should flow from these tools into your finance systems.

To overcome the challenges of a siloed and disjointed OTC process, companies need to rely on a single source of truth. This is what prompted our team to create the Leapfin Finance Data Platform which serves as a central repository of finance and operational data.

As Jason Berwanger, Leapfin’s Chief Architect explains:

The core concept of financial accounting is really around recording, classifying and summarizing operational events and transactions in the business. And the right way to solve that problem is to have a robust finance to operations integration. This is why Leapfin is taking this approach very intentionally.

Leapfin can help you translate operational data into financial transactions and insights. You get real-time insights into product, location, business line performance, etc. This is important because it allows you to see changes in your customer behavior and cashflow patterns in your business.

Caitlin added:

Leapfin’s advantage is that it can create detailed financial transactions out of operational data, regardless of where it comes from and how it’s formatted. We can ensure that those transactions are consistent and reconciled every single day. This is how you have the most recent, cleanest data at your fingertips.

Read next: Introduction to Cash Reconciliation

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.